2024: The Year Ahead

CommSec Chief Economist Craig James looks ahead at the outlook for the sharemarket in 2024.

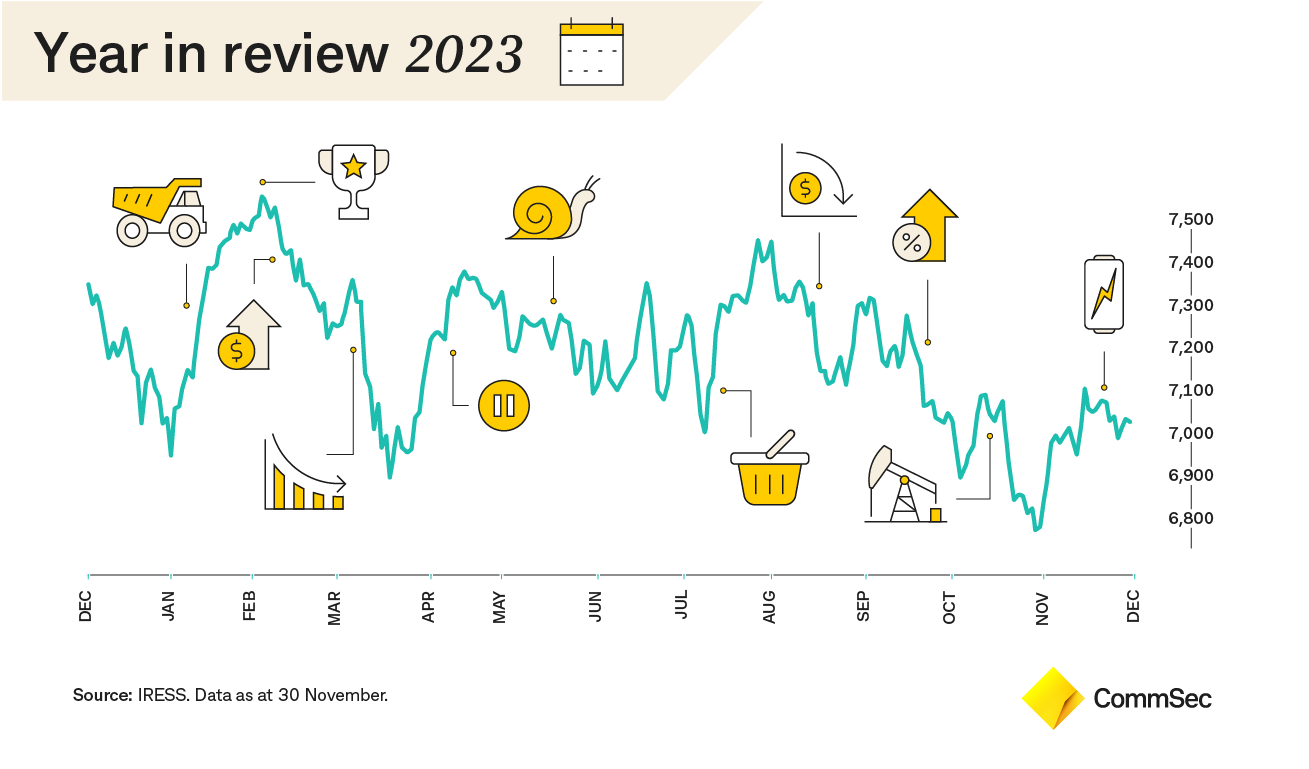

View the full screen here or by clicking the image.

You might also like...

Start trading today with Australia's leading online broker

This content is prepared, approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 (the Bank) and a Market Participant of ASX Limited and Cboe Australia Pty Limited. All information contained herein is provided on a factual or general advice basis and is not intended to be construed as an offer, solicitation or investment recommendation in any way. It has been prepared without taking into account your individual objectives, financial situation or needs. Past performance is not a reliable indicator of future performance. CommSec, the Bank, our employees and agents may receive a commission and / or fees from transactions and / or deal on their own account in any securities referred to in this communication and may make investment decisions that are inconsistent with the recommendations or views expressed within this communication. Any comments, suggestions or views presented herein may differ from those expressed elsewhere by CommSec and / or the Bank. The content may not be used, distributed or reproduced without prior consent and any unauthorised use of the content may breach copyright provisions. CommSec does not give any representation or warranty as to the accuracy, reliability or completeness of any content including any third party sourced data, nor does it accept liability for any errors or omissions. CommSec is not liable for any losses or damages arising out of the use of information contained in this communication. This communication is not intended to be distributed outside of Australia.