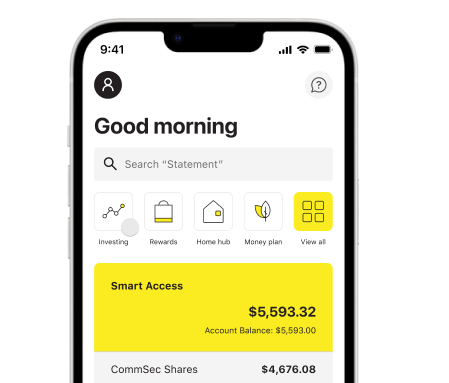

A simple way to kick-start your investing journey

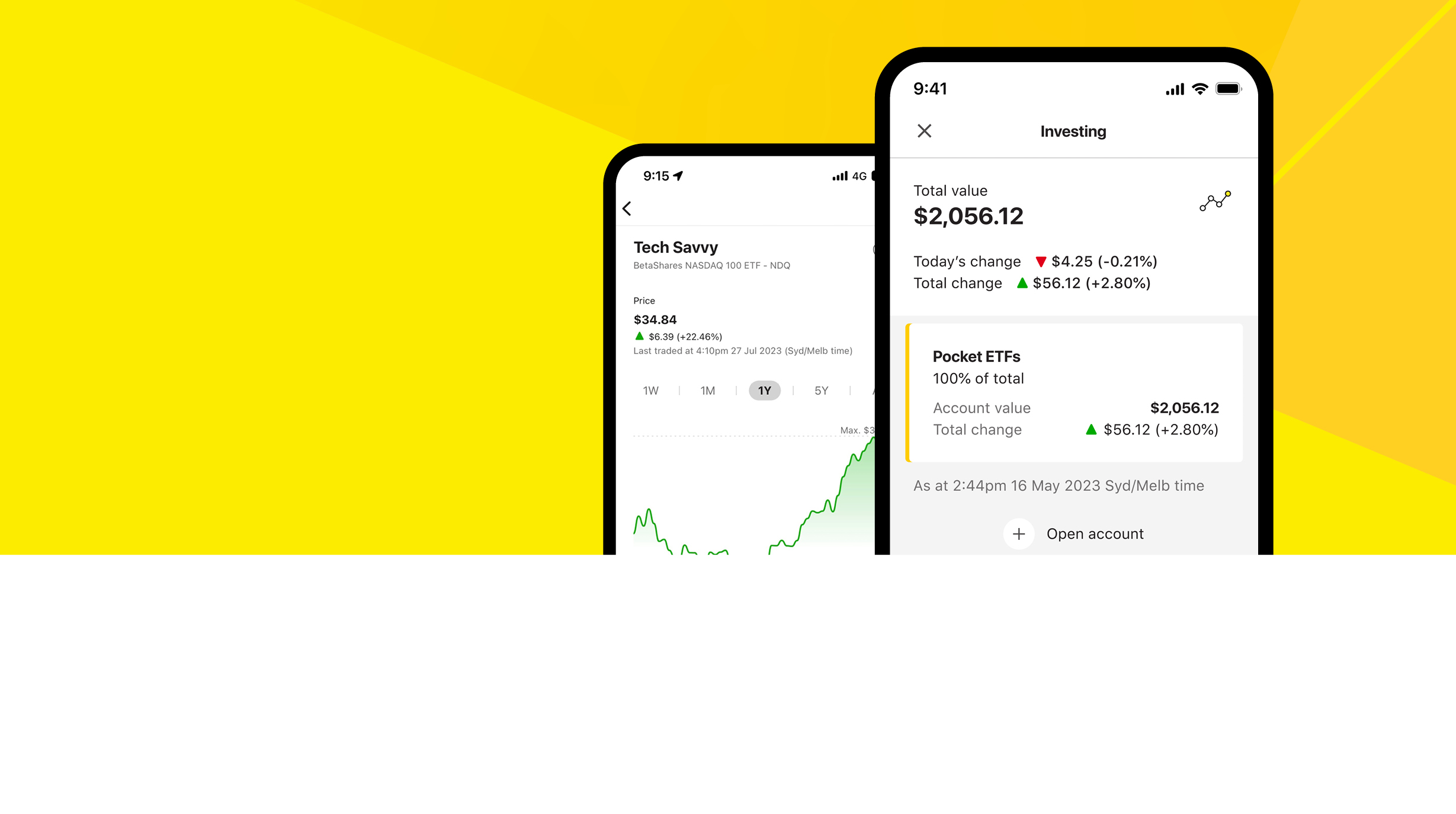

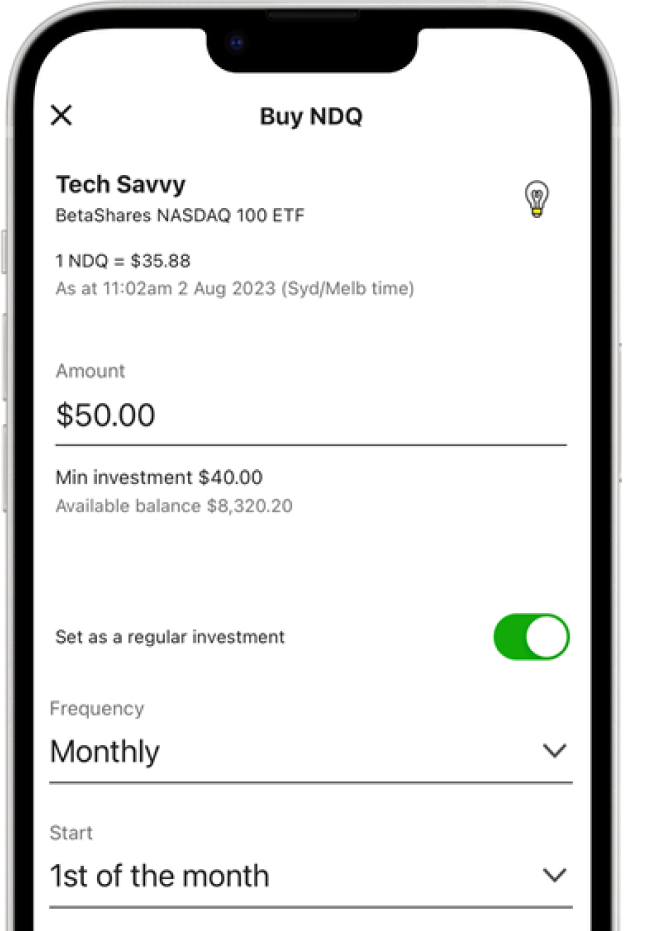

With CommSec Pocket you can get started with as little as $50 and build an investing portfolio over time.

Choose from ten themed ETFs and invest in something that appeals to you like tech, international companies, sustainability leaders or the biggest 200 companies on the Aussie market.

New to investing? Access easy-to-understand content along the way to get better acquainted with the share market.