![]()

Small upfront cost

Get started with as little as $50.

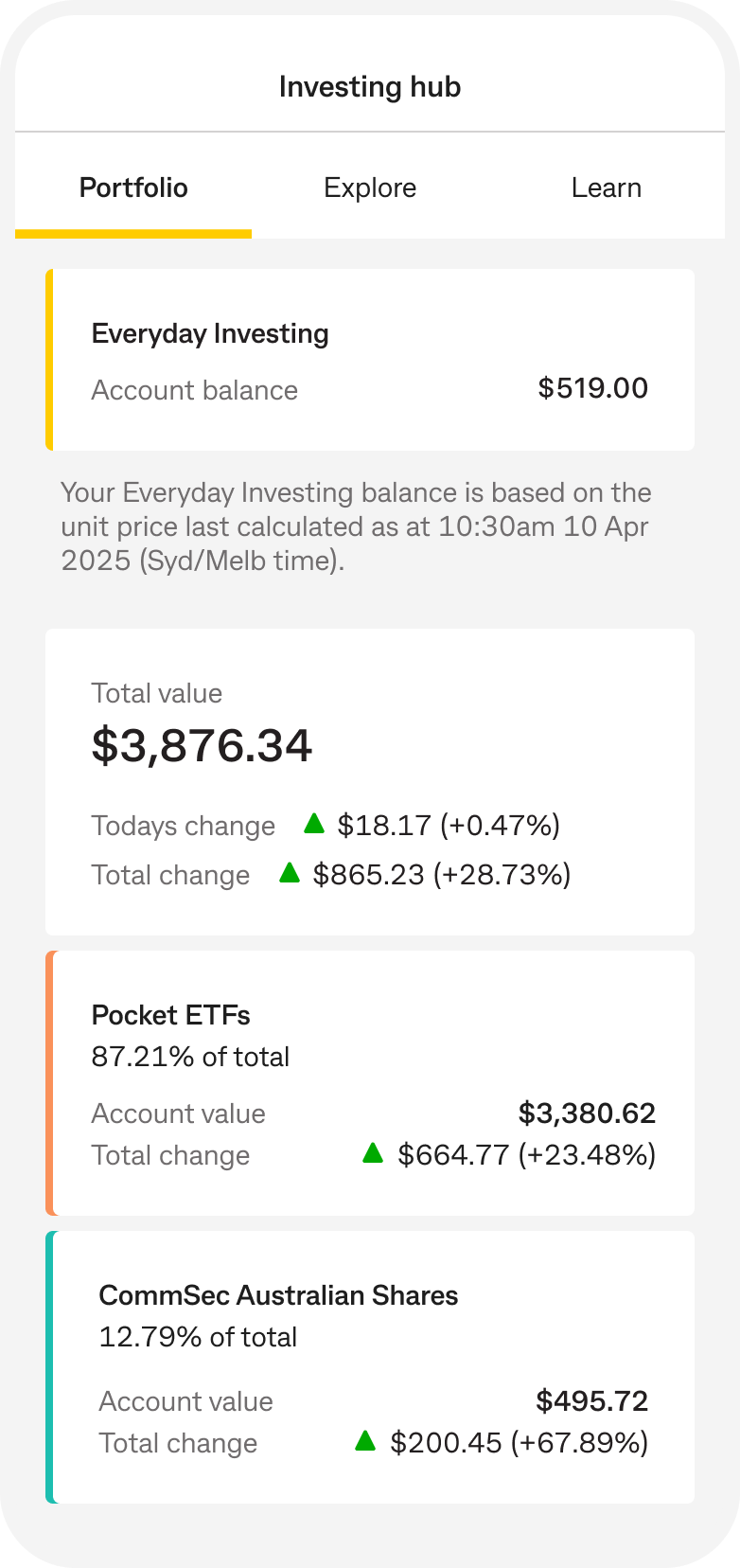

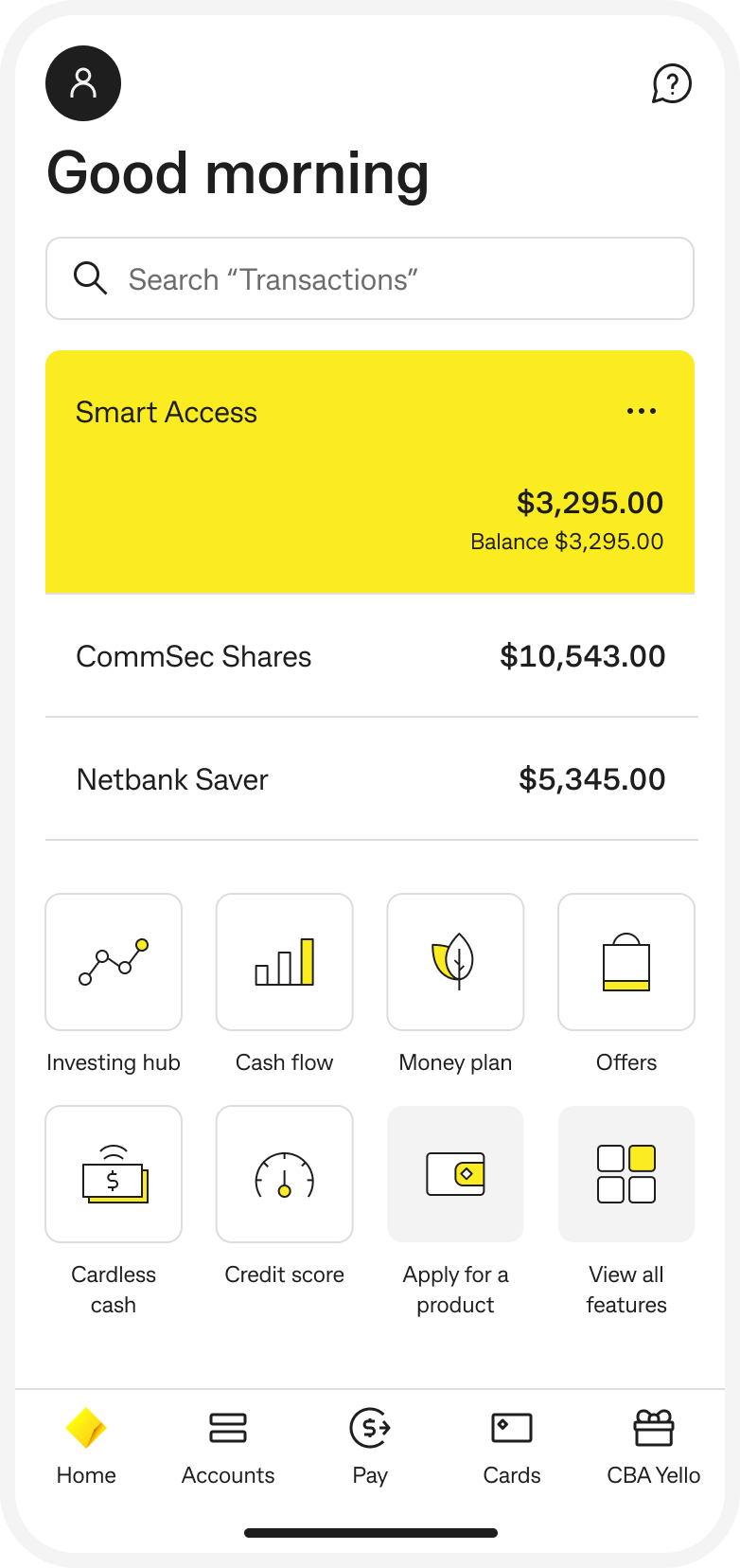

Invest in Pocket ETFs directly from the CommBank app.

![]()

Get started with as little as $50.

![]()

Browse, trade, and manage Pocket ETFs and shares listed on the Australian Stock Exchange (ASX) directly from the CommBank app.

Get started in the CommBank app in just a few taps.

Simple investing starts here

Start your investing journey in the CommBank app:

Invest in what matters to you

Our rates and fees

Opening a CommSec account is free and there are no ongoing account-keeping fees or management fees.

|

Trade amount |

Cost2 |

|

Up to and including $1,000 |

$2 |

|

Over $1,000 |

0.20% of trade value |

|

Fee |

Cost |

|

Late settlement fee |

$10 |

|

ETF management fee |

Each ETF provider charges a management fee for providing the ETF to investors. The fee is applied to your investment per year and varies depending on the ETF. It’s not an out-of-pocket fee. Rather, it’s deducted from the ETF’s unit price. The fee is shown when you browse the investments. The fee is charged by the ETF provider, not by CommSec. |

Start investing through the CommBank app

Here's how:

Pocket ETFs can be a great way to start if you’re new to investing. You can choose from 10 different Pocket ETFs which are curated to provide investors with access to different sectors and markets. You can choose to invest in one, some, or all of the options.

Investing Pocket ETFs through the CommBank app allows you to invest as little as $50 with a pay-as-you-trade brokerage fee and no ongoing account fees or management fees.

The ETFs are issued and managed by leading ETF fund managers. They are not issued or managed by CommSec.

By investing in Pocket ETFs through the CommBank app, you can start investing with as little as $50 at a time.

When the market is open on business days, your order to invest will be fulfilled that day. Outside of those times, your order will be fulfilled when the market next opens. The details are in our Best Execution Statement.

We then debit your bank account two business days (known as T+2) after your order is fulfilled. This is the standard process for investing in the share market: trade now and settle two business days later.

Yes, when you invest, you are buying an investment in ETFs. You can place an order to sell part or all of your investment at any time. The sale will occur when the share market is open on business days. You’ll receive the proceeds into your bank account two business days after the sale.

Find the support you need, when you need it.

| Send us your question Fill in our online form and hear from one of our experts within two business days |

|

| Call us 13 15 19 for calls within Australia |

|

| Reach out to us on X Tag @CommSec in your question on X |

1 The investing experience in the CommBank app is only available for CommSec Pocket and Individual CommSec Australian Share accounts. Other CommSec account types are not currently available.

2 Cost is based on trades placed online via the CommBank app. Cost is based on trades that settle in a CDIA. Trades linked to a settlement account from another financial institution and trades placed over the phone incur additional fees. See our rates and fees for more information.

3 The Commonwealth Direct Investment Account (CDIA) is issued by Commonwealth Bank of Australia. ABN 48 123 123 124 AFSL 234945. This product is administered by Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec), a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia. The target market for the CDIA can be found within the product’s Target Market Determination, available at commbank.com.au/tmd.

The following accounts are eligible for CommSec Pocket: CDIA, Streamline Basic, Cash Management Call Account, Cash Investment Account, Smart Access, Complete Access, Cheque A/c Not Bearing Interest, Cheque A/c Bearing Interest, Private Banking Account, Premium Business Cheque Account, Accelerator Cash Account, Everyday Offset Account.

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. The CommBank app is available on Android operating systems 7.0+ and iOS operating system 15.0+. Terms and conditions are available on the app. NetBank access with NetCode SMS is required.

You can view the CommSec Pocket Terms and Conditions, Share Trading Terms and Conditions, CommBank Transaction Savings and Investment Account Terms and Conditions, Best Execution Statement and Financial Services Guide (FSG), and should consider them before making any decision about these products and services. Consider the PDS for each ETF prior to making an investment decision. Past performance is not a reliable indication of future performance. Investing carries risk.