Create knowledge, create wealth

Take control of your investing journey. It’s never too late to start.

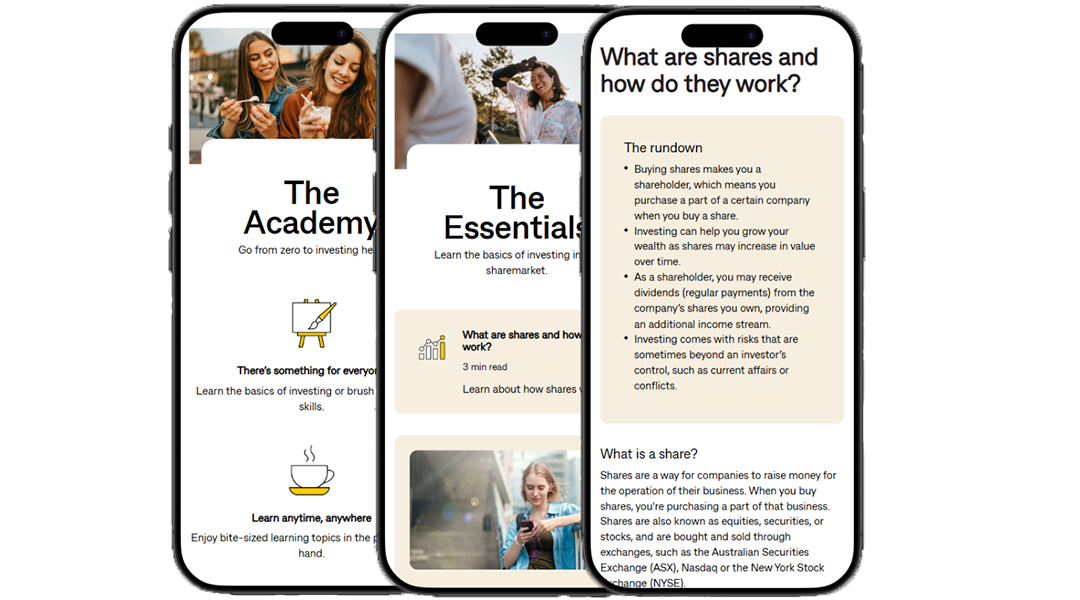

The Academy

Go from zero to investing hero.

![]()

There’s something for everyone

Learn the basics of investing or brush up on your skills.

![]()

Learn anytime, anywhere

Enjoy bite-sized learning topics in the palm of your hand.

![]()

Start your investing journey on the right foot

Get up to speed on investing in the sharemarket and beyond.

The Essentials

Learn the basics of investing in the sharemarket.

Ready to learn more?

Login to the CommSec mobile app, click More, then Learn to explore more of The Academy.

The Next Level

Already know the basics? Level up your investing knowledge.

Ready to learn more?

Login to the CommSec mobile app, click More, then Learn to explore more of The Academy.

More content to master

The Game Plan

What will I learn?

- How to create an investment strategy

- The difference between ETFs and individual stocks

- Investing in global sharemarkets

- How to spot different trends in the markets

And so much more...coming soon to the CommSec app

The Mastery

What will I learn?

- What margin loans are and how they work

- Estate planning for investors

- What Exchange Traded Options are and how they work

- What futures are and how they work

And so much more...coming soon to the CommSec app

Learn on the go

Boost your confidence in investing and discover the ins and outs of investing with the CommSec Invest podcast.

Love these episodes?

Most popular articles

Help when it matters

All the help you need, all in one place.

CommSec Learn is intended to provide general information of an educational nature only. You can view the product Terms and Conditions, Product Disclosure Statement, Best Execution Statement, Financial Services Guide and should consider them before making any decision about these products and services. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. Past performance is not indicative of future performance. Investing carries risk.

You can view the Share Trading Terms and Conditions, CommBank Transaction, Savings and Investment Account Terms and Conditions, Product Disclosure Statement, CommSec Best Execution Statement and Financial Services Guide, and should consider them before making any decision about these products and services.