During reporting season an investor may see a large swing in a company’s share price right after its annual report was released to market. This shift in price usually coincides with the report exceeding or missing the markets expectation. A long strangle is an Options Strategy that an investor can use to take advantage of increasing volatility and where there is uncertainty in which way the share price is going to move.

The strategy consists of simultaneously buying an out-of-the-money call option which benefits from a strong rise in share price coupled with buying an out-of-the-money put option which benefits from a large fall in the share price.

When selecting the call and put option to purchase it’s important to keep in mind that the closer the chosen strike prices (right to buy for a call or right to sell for a put) are to the current market price of the underlying, the higher the premium will be to open the Options Strategy. The further out-of-the-money the strike prices are, the larger the movement in the underlying share price is required in order for the investor to make a profit.

The investor should have the expectation that the underlying will have a strong move in either direction during the lifetime of the strategy. For a successful long strangle strategy, the movement in the underlying must be far enough past the strike price for either the call or put option to cover the cost of the long strangle. It is important that the chosen expiry date allows sufficient time for the underlying to make this significant move.

If there is a significant downwards move in the underlying the bought put option becomes in-the-money and the value of the put option could be higher than the price paid to buy the put option. Alternatively, if there is a significant upwards movement in the underlying the value of the call option could increase to a price higher than the price paid to buy the call option.

Time decay is a major factor in this strategy, the closer to expiry the more time value is lost. If the expected movement has not occurred, the investor may consider closing the positions before the options expiry date and before time decay starts to majorly impact the value of the positions.

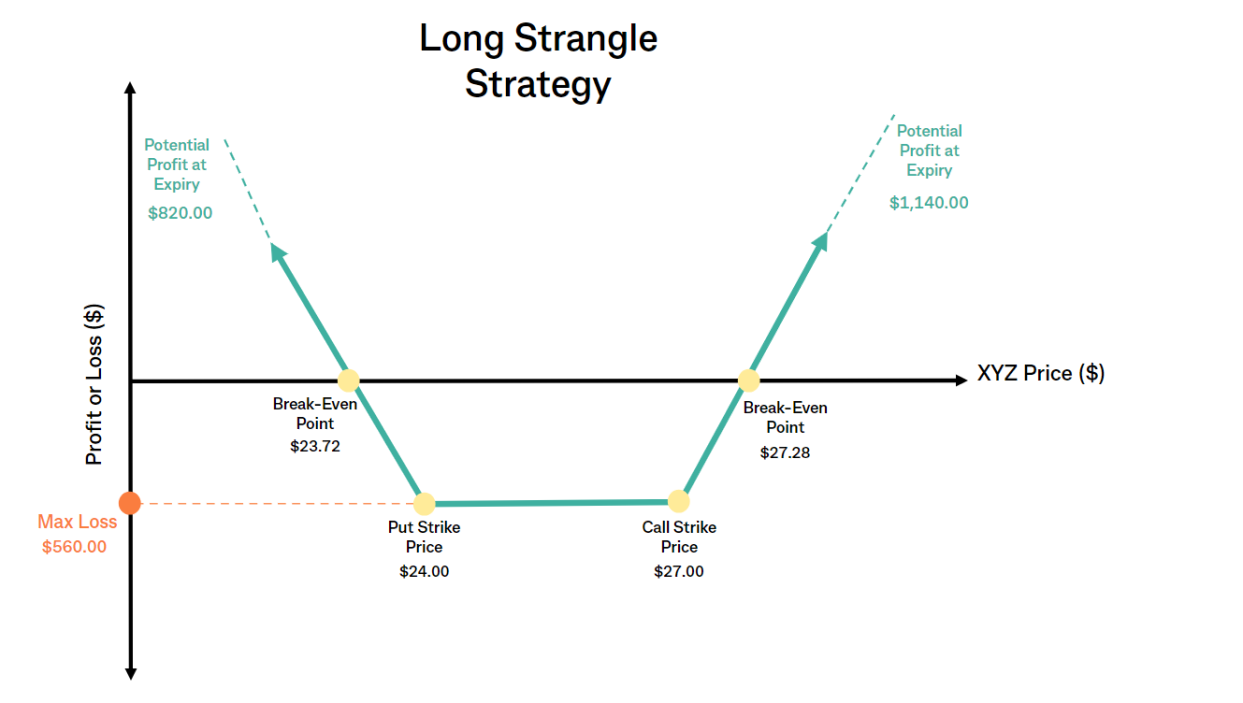

The investor’s maximum potential loss using a Long Strangle is the premium paid for both the Call and Put options. On the other hand the potential profit of a Long Strangle is unlimited on the upside. On the downside the potential profit is limited as the underlying’s price as it cannot fall below zero.

Hypothetical Example

For the upcoming reporting season, an investor could open a Long Strangle over company XYZ one week prior to them reporting. The investor anticipates a large shift in the underlying share price after the report is released however is undecided as to what direction the stock will move. Given the investor's view, a long strangle options strategy could be used to potentially profit from a strong move in the share price in either direction.

XYZ is currently trading at $25.40 a week prior to their results being published. The investor enters the below position;

Buy 20 $24.00 put options with August-24 expiry at $0.13

Buy 20 $27.00 call options with August-24 expiry at $0.15

The investor pays a total premium of $560 ($0.13 + $0.15) x 100 shares per contract x 20 contracts). This is the investor's maximum potential loss.

If XYZ results exceed expectations and XYZ share price rises to $27.85 by expiry,

The bought put option becomes worthless.

The bought call option increases in value as it is now in-the-money, and will have an estimated premium of $0.85.

The investor can sell to close the call option for a total premium of $1,700 ($0.85 x 100 shares per contract x 20 contracts).

The investors total profit is $1,700.00 - $560.00 = $1,140.00.

If XYZ results miss expectations and, their share price drops to $23.31 by expiry,

The bought call options becomes worthless

The bought put option is now in-the-money and will have an estimated premium $0.69.

The investor can sell to close the put option for a total premium of $1,380 ($0.69 x 100 shares per contract x 20 contracts).

The investor total profit is $1,380.00 - $560.00 = $820.00.

If XYZ releases their results and it meets market expectations, their share price then stays stable around $25.40,

The investor can consider selling to close both the call and put options prior to expiry to recoup some premium.

The investor can let both option positions expire worthless and for a loss of the $560.00 premium.

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited

You can view the Exchange Traded Options Product Disclosure Statement, Exchange Traded Options Terms and Conditions, CommSec Best Execution Statement, CommSec Financial Services Guide, and should consider them before making any decision about these products and services. There can be high levels of risk associated with trading in Options; only investors familiar with the risks of Options trading should consider these products.

The target market for this product can be found within the product’s Target Market Determination, available here.