Did you know that investors can safeguard the value of their shareholding by employing a protective put strategy?

This strategy can be used by investors with existing shareholdings who are concerned that the share price of their holdings may fall in the near term.

What is a protective put strategy?

A protective put strategy consists of two positions:

- An existing holding of a particular share; and

- Buying a put option1 over that particular shareholding.

When an investor purchases a put option on a share, it gives them the right (but not the obligation) to sell the underlying shares within a set time period at a predetermined price (also known as the ‘strike price’). The put option acts as a safeguard against a fall in the underlying share price, as it locks in the lowest price the investor can sells their shares at.

A protective put strategy can be likened to a stop loss that can be executed at the investors’ discretion to sell the underlying shares at a predetermined price (strike price), should the underlying share price fall.

The strike price will determine where the downside protection or stop loss kicks in, and the investor needs to balance their desired level of protection against their investment goals when choosing the strike price.

How does it work?

The investor will need to ensure they are purchasing enough put option contracts to fully cover (protect) their holding of the underlying shares. In practice, one put option contract covers 100 shares of the underlying (assuming no options adjustment has occurred).

When selecting the strike price for the put option, the investor should also be aware of how the strike price impacts the premium value (the price) of the put option.

The premium (price) of the put option will increase the more the strike price is above the current underlying price (the further in-the-money2).

If the chosen strike price is lower than the current underlying price (out-of-the-money3), the premium is lower but less protection is provided to the investor (the investor can still incur a loss on the shareholding if the share price falls).

The strike price of the put option is commonly set slightly below the current share price of the underlying (out-of-the-money). The idea behind this is if the underlying share price falls below a certain level (the strike price) the investor has the right to sell their underlying shares at the higher strike price. This allows the investor to help offset the decline in the underlying shares.

What if the outlook on the share price changes?

If the underlying share price has dropped and the investor now has a more bullish outlook (they think the share price will rise), they can change their strategy to match this new outlook. The investor could close the put option (selling to close) and receive a premium in return, while also retaining the underlying shares to benefit from the potential share price increase.

Alternatively, if the investor’s outlook has turned bearish for the long-term (they think the share price will continue to fall), they can exercise the put option to sell the underlying shares at the strike price and limit their losses. Exercising the option can either be done prior to the expiry date or on the expiry date of the option, depending on the expiry type (American4 or European5).

If the underlying share price does not fall and the put option expires out-of-the-money, the protective put will expire worthless and the investor will retain the underlying shares.

Remember that a share’s price can rise or fall depending on a number of factors, and that a share’s outlook at the time of buying a put option may be different to when the option is due to expire.

What are the risks?

Movements in the underlying share price will generally change the price of the put option. If the underlying price increases then the put option may become worthless. It’s also possible that the change in price of the option may be in a different magnitude to the change in price of the underlying shares.

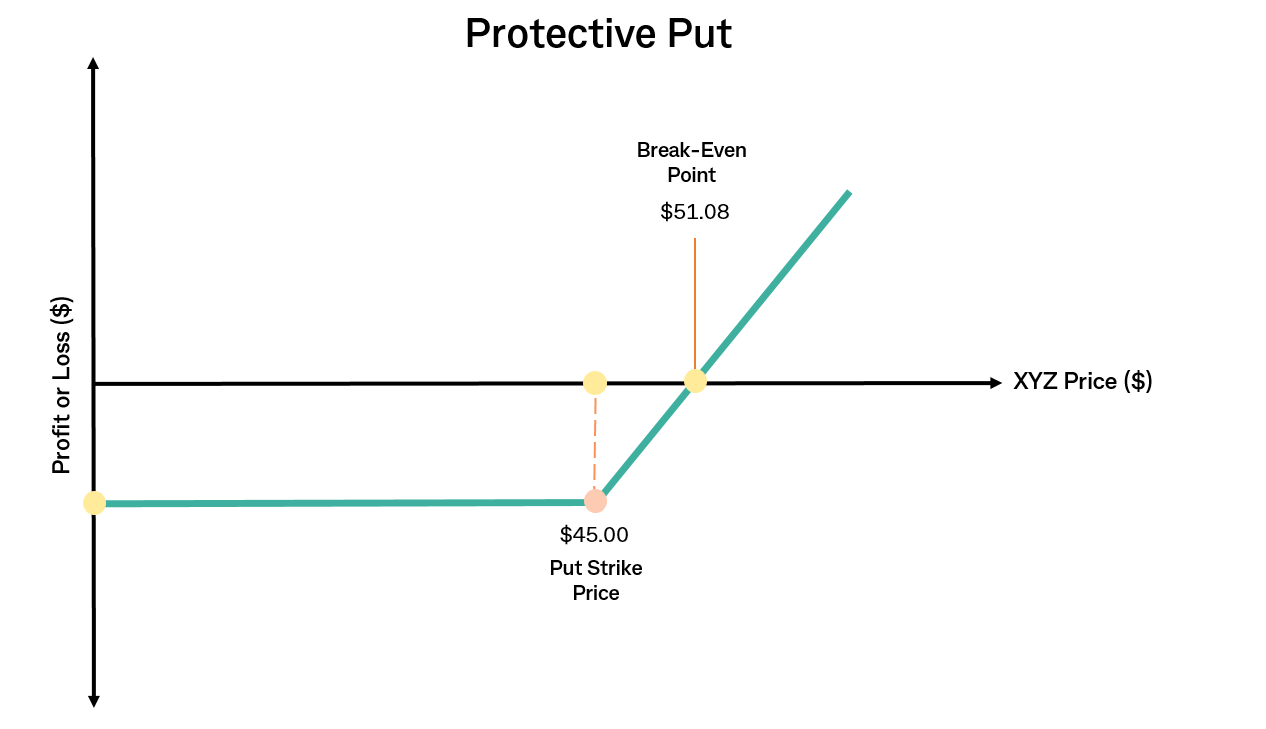

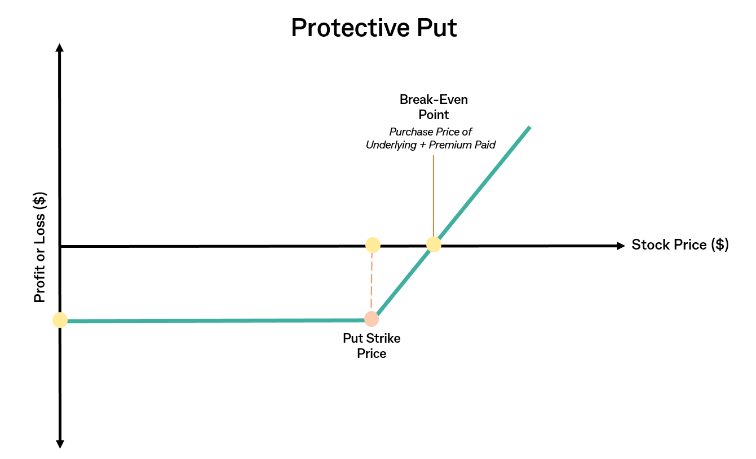

As the investor already holds the underlying shares in a protective put strategy, the potential maximum profit is unlimited. However, the profit at the expiry will be offset by the premium (price) paid for the put option.

On the other hand, the maximum potential loss is limited to the difference between the underlying share price and the strike price, plus the premium (price) paid for the put option.

It’s important to remember that put options have an expiry date and therefore a limited life. A put option’s value erodes over its life (known as time decay6), and this accelerates as the option nears expiry.

Hypothetical Example

This example is hypothetical and for illustrative purposes only. The stock chosen is hypothetical and actual results may vary significantly.

An investor holds shares in company XYZ and is confident in the long-term outlook for the share price. However, the investor is concerned that the price of XYZ may fall in the near-term and wants to protect the value of their holdings.

The investor holds 2,000 units of XYZ and XYZ is currently trading at $50.00 (total value of $100,000). The investor places the below trade:

- Buys 20 XYZ $45.00 put options (3 months’ expiry) for $2,160 ($1.08 per share)

In the case the investor’s expectation was correct and the XYZ share price falls to $41.00:

- The investor’s shareholding of XYZ is now worth $82,000 ($18,000 less than when the put option was purchased).

- The investor has the right but not the obligation to sell the XYZ shares at the strike price of $45.00 ($10,000 less than when the put option was purchased).

- If the investor exercises the put option, they are $5,840 better off than if they had not purchased the put option ($8000 less the $2,160 option premium).

- If the investor does not want to sell the XYZ shares, the investor could sell to close the put option which could offset some of the losses incurred from the XYZ share price drop.

In the case the investor’s expectation was incorrect and the share price of XYZ rises to $59.00:

- The investor’s shareholding of XYZ is now worth $118,000 ($18,000 more than when the put option was purchased).

- The put options are now worthless, and the investor has incurred a $2,160 loss to buy the put options ($1.08 x 100 shares per contracts x 20 contracts). The investor is $2,160 worse off than if they had not purchased the put options.

- However, this loss is offset by the gain made on the share price increase of XYZ

In the case the XYZ share price stays stable around $50.00:

- The value of the investor’s shareholding of XYZ is unchanged at $100,000

- The put options are worthless, and the investor has incurred a $2,160 loss to buy the put options.

The break-even point in this example is $51.08 (the purchase price of $50.00, plus the option premium of $1.08 per share):

- Put Option – Gives the holder the right, but not the obligation, to sell the underlying asset at a predetermined price (strike price) by a specified date (expiry date)

- In-the-Money – For a call option, when the strike price is below the current underlying price. For a put option, when the strike price is above the current underlying price.

- Out-of-the-Money – For a call option, when the strike price is above the current underlying price. For a put option, when the strike price is below the current underlying price.

- American Expiry Type – Options which can be exercised at any time before and including their expiry date.

- European Expiry Type - Options which can only be exercised on the expiry date.

- Time Decay – Options will depreciate in value as an options contract nears the expiry date, the rate of this decline accelerates as the expiry date draws closer.

Key Points to Remember

- Provides protection against potential losses

- Losses are capped at the difference between the strike price and underlying share price, plus the put option premium

- Offers flexibility as ownership of the underlying shares can be maintained whilst hedging against market downturns

- Allows for investors to still profit from share price rises, whilst providing downside protection

Important Information

Neither the Commonwealth Bank of Australia nor CommSec specifically recommend the stock or strategies used in this example.

The information has been prepared without taking into account your objectives, financial situation or needs. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to their objectives, financial situation or needs, and, if necessary, seek appropriate professional advice. Investors should also obtain professional taxation advice that addresses their individual circumstances before taking out an investment loan.

You can view the Exchange Traded Options Product Disclosure Statement, Exchange Traded Options Terms and Conditions, CommSec Best Execution Statement, CommSec Financial Services Guide, and should consider them before making any decision about these products and services. There can be high levels of risk associated with trading in Options; only investors familiar with the risks of Options trading should consider these products.

The target market for this product can be found within the product’s Target Market Determination, available here.