Market Watch

This timely update will provide you with valuable insights and analysis, helping you plan your next move while the share market is open for trading. Watch the weekly Market Highlights to see what's happening in the share market.

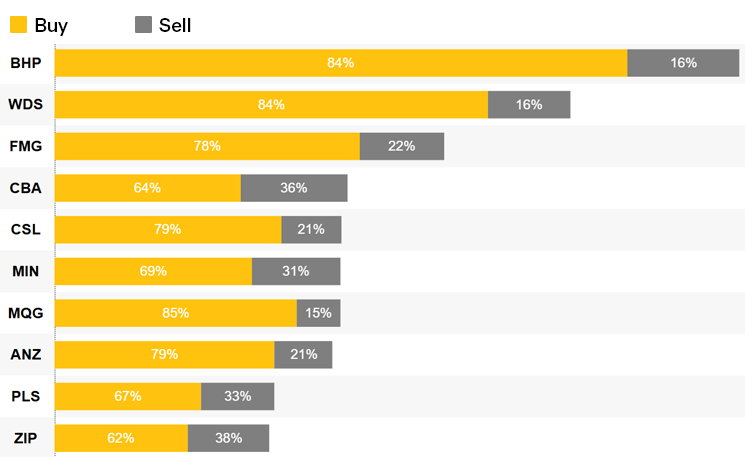

Top 10 traded Australian shares

Between 02/03/26 - 06/03/26

Last week's most commonly traded Australian shares^ by CommSec clients. Based on contract note volumes (bought or sold weekly).

Market movers

See what’s happening in the share market with the latest news headlines and company performances. You can also view the Daily Alert and Weekly Market reports.

Go to Quotes and Research > Markets

Upcoming dividends

Check out our upcoming dividends page to see which stocks are scheduled to pay dividends.

Go to Quotes and Research > Tools > Upcoming Dividends

Investment opportunity

Explore stocks that match particular industries or trends with our Investment Themes.

Go to Quotes and Research > Trading Ideas

Important information

^Any securities noted in the most commonly traded shares by CommSec clients in the period quoted should not be considered as a recommendation. Past performance is not a reliable indicator of future performance. This does not represent a recommendation to buy, sell or hold shares, an endorsement or a guarantee in regard to the future performance of any share price.

The content is not a recommendation.