Must reads - Tax Time

What statements are available?

The following statements are now available:

- Financial Year Summary – an overview of your CommSec account for the year, including summaries of your portfolio valuation, estimated interest and dividends, fees and charges. A summary of the total payment received from the CommSec Yello Investing benefit is also included.

- Portfolio Valuation – a report of your CommSec holdings and their values as at 30 June, giving you a year-end snapshot of your position.

- Transaction Summary – a list of your executed trades with CommSec, to help you work out your capital gains and losses, and transaction costs.

- Interest and Estimated Dividend Summary – a list of estimated dividend and interest payments which may help you work out the income performance of your portfolio.

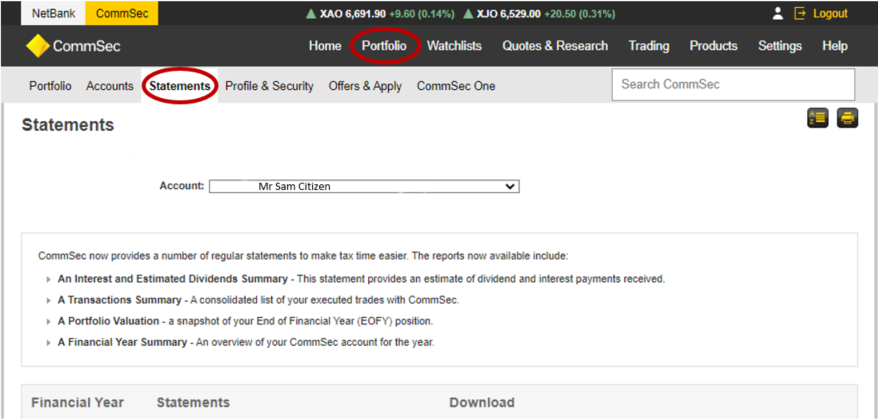

How to download your statements

You can access your Statements here, or alternatively select ‘Portfolio’ > ‘Statements’ on the homepage.

Frequently asked questions

To view your statements, log in to CommSec, go to Portfolio, select Statements and then choose your trading account.

All End of Financial Year Statements are available in PDF format. The Transaction Summary Statement is also available in CSV format.

The easiest way to get your statement is by logging into the website and navigating to Portfolio > Accounts > Statements.

Please contact us to discuss your options.

The end of financial year share statement only captures CommSec CHESS sponsored holdings. If you have Issuer Sponsored Holdings or holdings with another broker, they will not be included in this summary.

Other fees can include, but are not limited to:

- Off Market Transfer fees

- Settlement fees

- Fail fees

- Shareholder Reference Number (SRN) query

- Rebooking fees

- Cheque payment fee or cheque dishonour fees

- Printing and posting contract notes

Your CDIA Statement and Interest Summary can be downloaded by logging into your Netbank account. You can also access Netbank from CommSec (if you are logged in) by using the Netbank link located in the top left of the screen.

To view your CDIA Statements, select View accounts, then Statements, then click on the drop down arrow next to 'View statements for' and choose your CDIA account.

To view the total interest received for the financial year, select View accounts, then Account information, and then select your CDIA account from the drop down menu.

If you need help finding your CDIA statement, please call CommSec on 13 15 19 or +61 2 8397 1206 if calling from overseas between 8am and 6pm, Monday to Friday (Sydney time).

Disclaimer

This statement is a summary document only and it is not intended to replace any document which contains information that may be required for taxation purposes. You should therefore retain your CHESS statements, dividend statements, confirmation contract notes and bank account statements for your records in this regard. If there are any errors in this statement, please contact us on 13 15 19. The total brokerage outlined does not include any rebates you may have received over the financial year. Please refer to your transaction statement records for any rebates you may have received for the report period. This report only includes dividends paid for holdings held with CommSec. Any dividends paid (based on the ex-dividend date) prior to holdings being transferred to CommSec are not included in this report. This report may not include information on some accounts if you have switched products during the financial year. CommSec is not a registered tax practitioner and the information provided in this report does not constitute tax advice. It is recommended that you provide the report to your tax adviser or accountant so that your particular circumstances can be properly addressed.