How do I place a trade on my Exchange Traded Options (ETO) account?

Options orders (incl. multi-leg orders) can be placed either online via CommSec website or over the phone by speaking to CommSec Options Support.

To place a single-leg ETO order online:

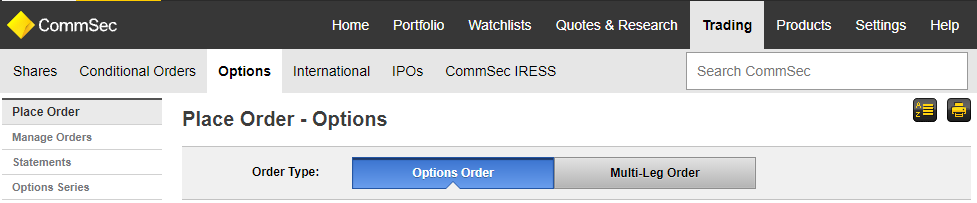

1. After logging in, click on Trading > Options > Options Order (note: you need an ETO account to be able to access this).

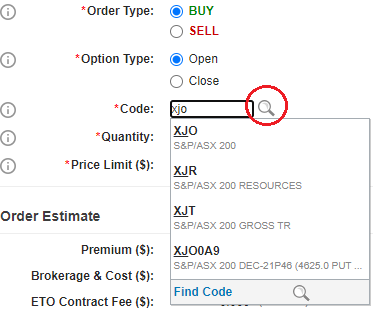

2. Choose BUY or SELL and Open or Close. Remember, Open or Close refers to whether you are opening a new position or closing out an existing one.

3. If you know the option you want to trade, skip to step 5. Otherwise, enter the underlying code and select the magnifying glass.

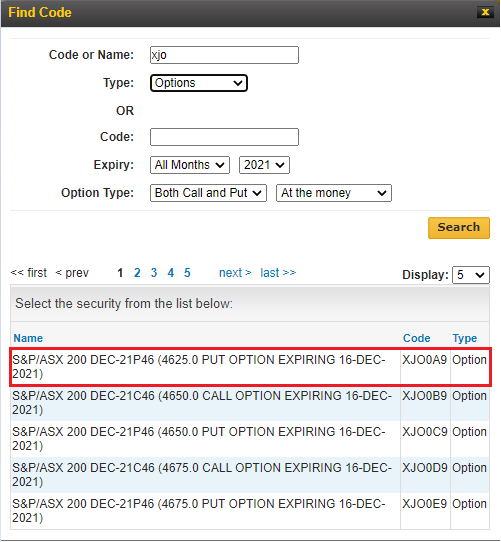

4. Under type, select Options and use the various search filters to find the option you want to trade. From the list, click on the Options series that you are interested in to add it to the order details screen.

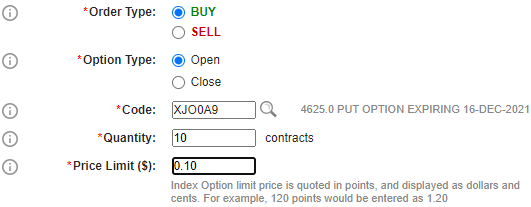

5. When you have decided which option to trade enter the code and the quantity you would like to trade (remember in most cases each option contract covers 100 shares).

6. Enter the limit price you would like. If you haven’t decided on a price, view our guide on how to request an exchange traded options quote.

7. If you are comfortable with the order estimate, click Proceed, then Submit Order.

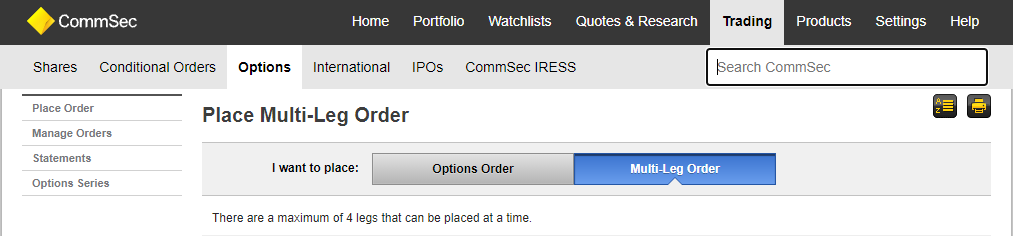

To place a multi-leg ETO order online:

1. After logging in, click on Trading > Options > Multi-Leg Order (note: you need an ETO account to be able to access this).

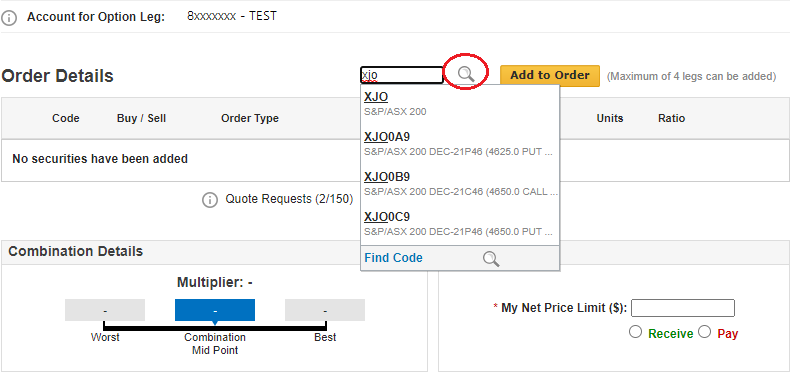

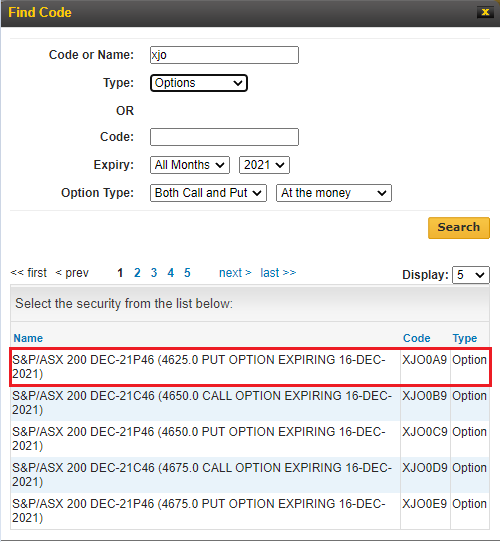

2. If you know the Options code, skip to step 4. If you don't know the Options code and need to search for a specific Option, enter the underlying code (e.g., BHP or XJO) and click the magnifying glass to search.

3. Under type, select Options and use the various search filters to find the Options you want to trade. From the list, click on the Options series that you are interested in to add it the order details screen.

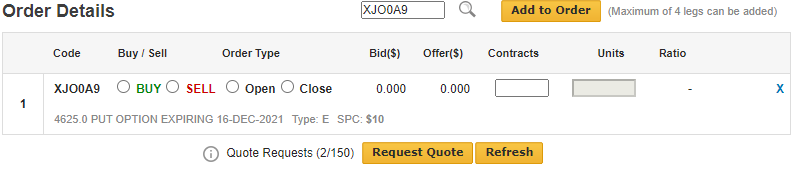

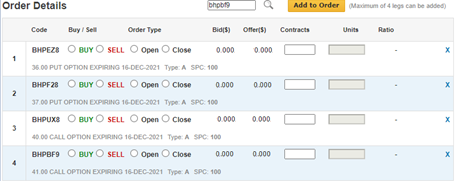

4. When you have decided which Options to trade, enter the code and click Add to Order. It should appear in the order pad as below.

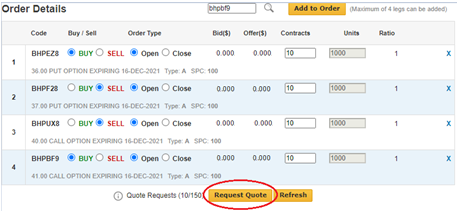

5. Repeat steps 2 - 4 until all legs have been added.

6. Select BUY or SELL and Open or Close and add the number of contracts for each leg. Click Request Quote, wait 10 seconds then click Refresh (for a more in depth explanation regarding requesting quotes, visit our guide on how to request an exchange traded options quote.

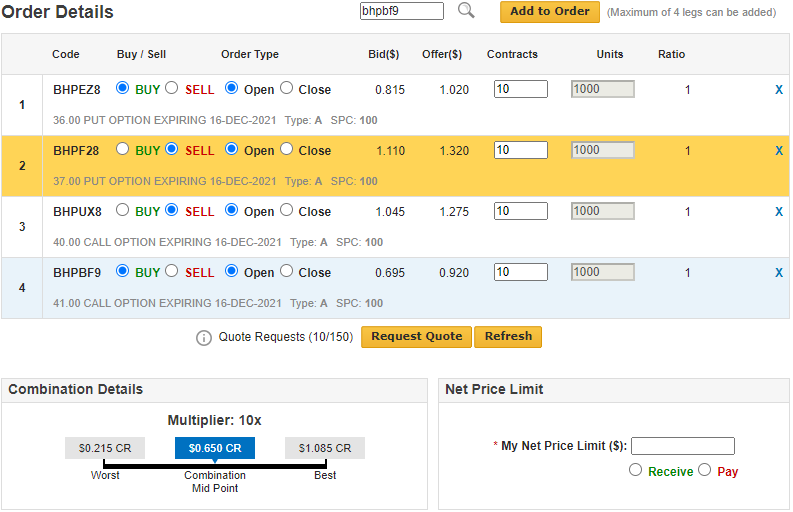

7. You should notice the Bid and Offer columns are now populated and an order estimate has appeared below.

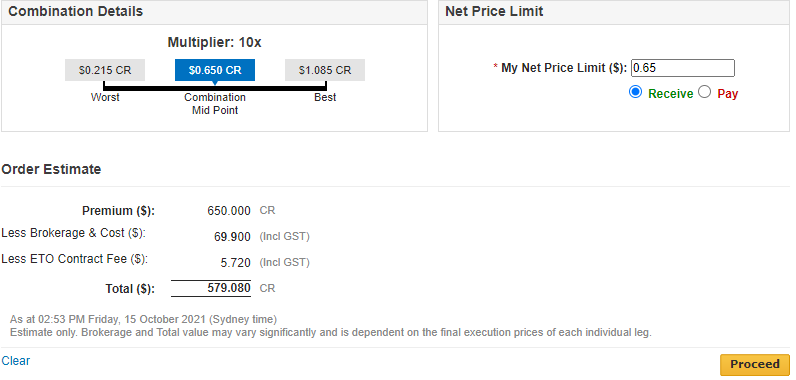

8. Enter your price in Net Price Limit and select Receive or Pay. Best, Worst and Combination Midpoint are provided to assist you in your decision making. For a more in depth explanation on Best, Worst, and Combination Midpoint, visit our guide on how to request an exchange traded options quote.

9. If you are comfortable with the order estimate, click Proceed then Submit Order.

We're here to help

To place Options orders over the phone or if you require further information, please call the CommSec Options Support on 13 15 19 or if calling from overseas +61 2 8397 1206 (8am to 6pm, Monday to Friday, Sydney time).

Learn more about Exchange Traded Options Trading and Strategies.

Disclaimer

The Exchange Traded Options TMD can be located on the CommSec website.