Diversification

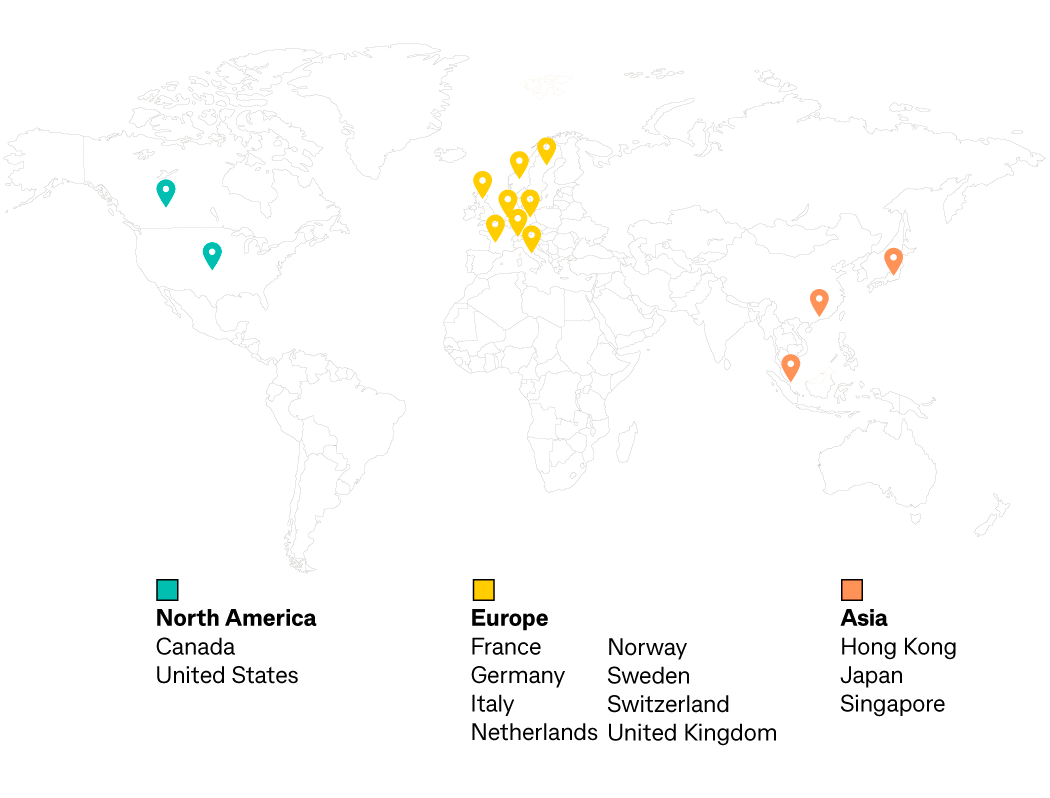

Through CommSec, build your portfolio by investing in 13 international markets online and gain access to sectors that are better represented internationally such as artificial intelligence and aerospace^.

Access the biggest global companies

Invest in the global brands you know and love such as Apple, Shell, Shopify, Toyota^ and much more!

Fractional shares

Fractional shares allow you to invest smaller amounts, so you don’t have to pay the value of a full share. Keep growing your portfolio and invest in select U.S. and European shares you might not have considered before. Find out more about fractional shares.

24-hour support

Our International Desk is always here to help. Open 24-hours on U.S. Market Days, support will be there when you need it.

Simplified access to trade on your funds

With CommSec, you can enjoy being able to trade on funds from sell trades before they settle, and if you need a top up you can transfer funds in and out* of your account, in real time.

US Overnight Trading

Trade over 10,000 US Stocks and ETFs between 8.00pm EST and 3:50am EST Sunday to Fridays.

Recurring Investments

Automatically invest an amount into an international security based on a recurring investment schedule that suits you.