1. What’s an ETF?

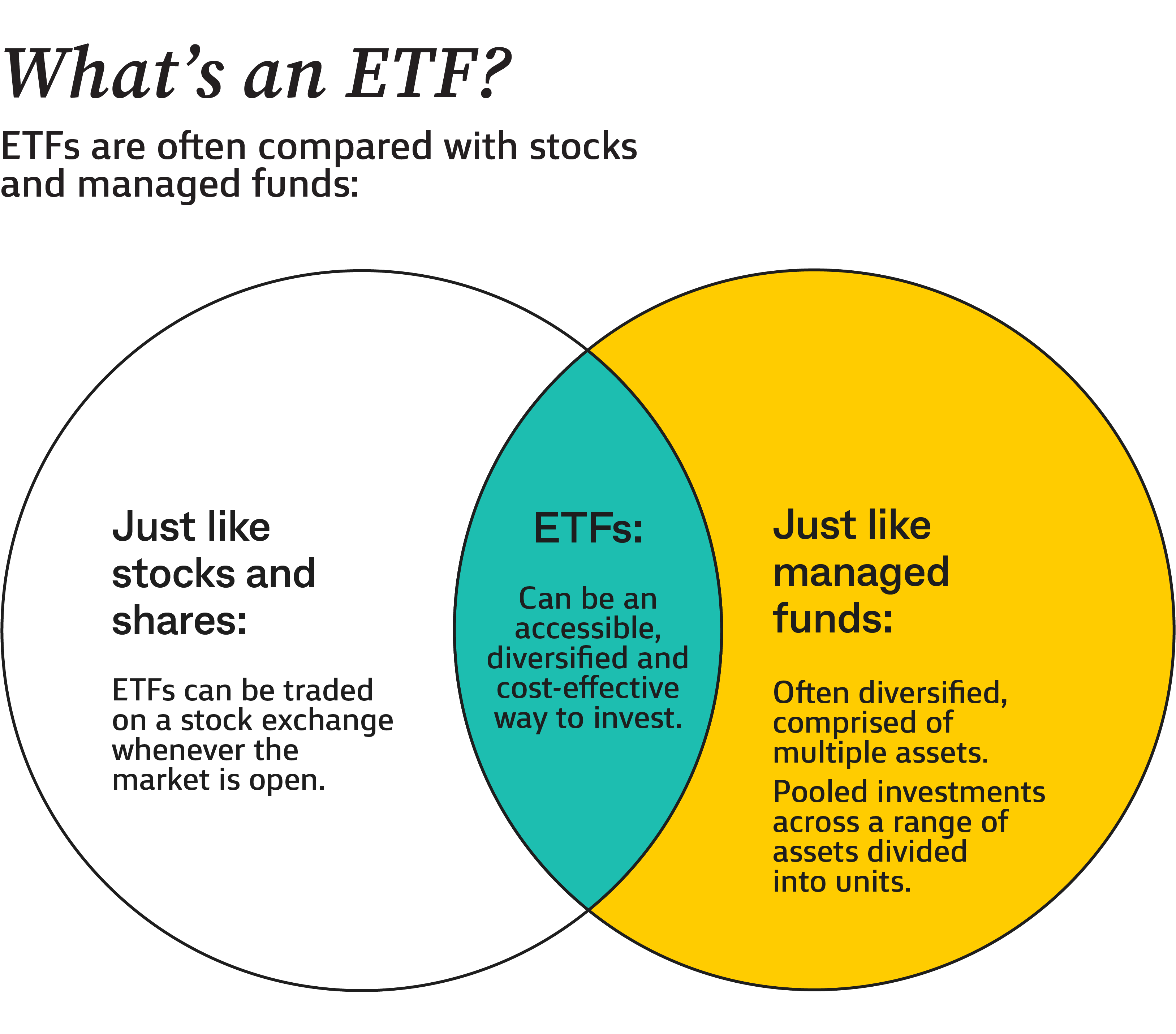

Exchange-traded funds (ETFs) are pooled investments. They buy a range of assets and then divide ownership into units for investors to buy, trading on a stock exchange just like shares.

In short

- ETFs are traded on a stock exchange like shares

- An ETF buys a range of assets and then divides ownership of itself into units for investors to buy

- You will own shares in the ETF, while the ETF owns the underlying assets

- ETFs can be a simple, cost-effective investment option

When you buy an ETF you own a share in the fund, and the fund owns the underlying assets. They can be a simple, cost-effective investment option that provide access to a range of diversified assets.

Think of ETFs like a basket filled with shares from different companies, or other investments like bonds. Buying a company’s share gives you interest in just that one company, while buying a share in an ETF gives you an interest in the basket of various shares that the fund is invested in.

Some ETFs are designed to invest in companies from particular sectors, like technology, or different countries or regions. So, ETFs have the ability to help diversify your investments in a timely, cost-effective manner.

For example, instead of buying every ASX 200 company, you can purchase a single ASX Index ETF to achieve essentially the same exposure, while letting its managers worry about tracking the 200 individual companies that the ETF is comprised of.

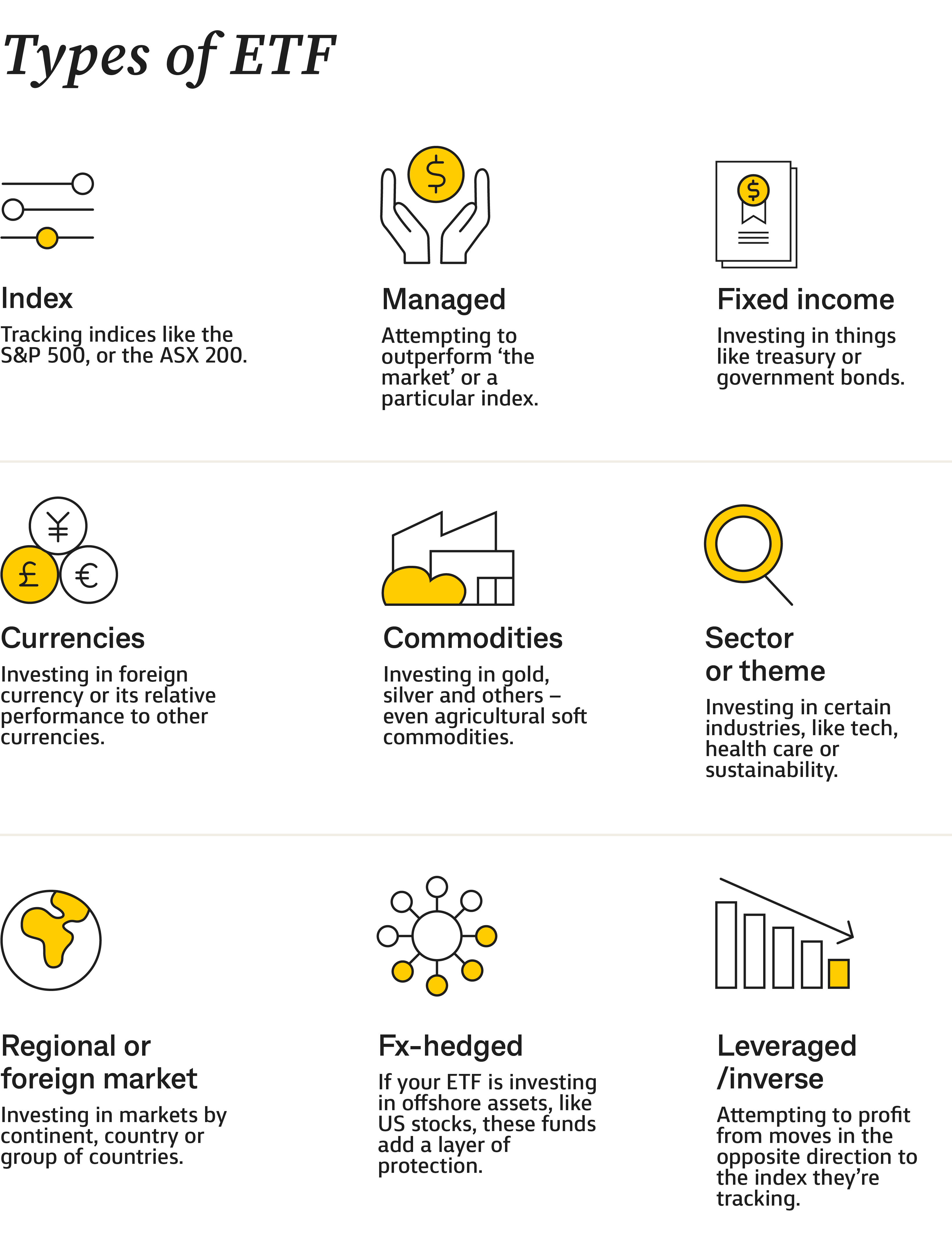

Equities: Equity ETFs track indices like the S&P 500, or the ASX 200.

Fixed income: These invest in things like US Treasuries or Australian government bonds.

Currencies: These invest in foreign currency and allow investors to gain exposure to the direction of a particular—or a group—of currencies, compared to another.

Commodities: Think gold, silver, iron ore or even agricultural soft commodities, like soybeans.

Sector: These focus on certain industries, like technology or health care.

Regional: They can be broken down into continents, or by country or a group of countries that share a similar theme.

Fx-hedged: If your ETF is investing in offshore assets, like US stocks, these funds add a layer of protection should the value of the Australian dollar change, which can affect the value of your investment.

Leveraged/inverse: These products use financial instruments to boost their investment.

In the case of leveraged ETFs, or for inverse funds, they move in the opposite direction to the index they’re tracking. They are very speculative and come with their own set of risks that need to be fully considered, and are much more suited to experienced traders.

Next

Disclaimer

CommSec Learn is intended to provide general information of an educational nature only. The information has been prepared without taking into account your objectives, financial situation or needs. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to their objectives, financial situation or needs, and, if necessary, seek appropriate professional advice. You can view the product Terms and Conditions, Product Disclosure Statement, Best Execution Statement, Financial Services Guide and should consider them before making any decision about these products and services. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. Past performance is not indicative of future performance. Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.