After the rally, can ZIP continue higher?

11 November 2025

Author: Sandstone Insights

Despite ZIP’s share price rising over 300%+ from the April 2025 lows, there is still plenty to get excited about. After a strong FY25 result where ZIP delivered Total Transaction Value (TTV) growth in the US of 41.6%, momentum has continued into the FY26 year, with ZIP expecting TTV growth of “greater than” 35%. In our view this could be conservative.

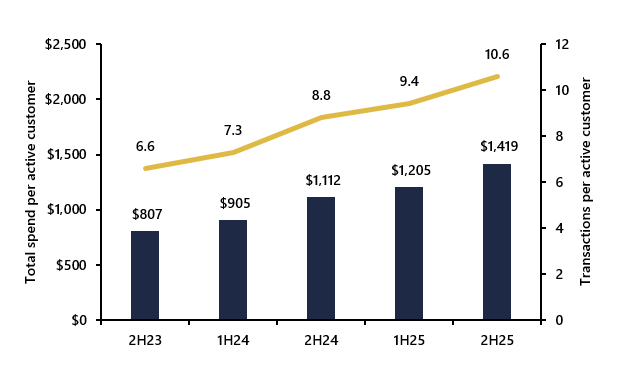

Importantly for ZIP, it has expanded the category offerings from discretionary goods, and introducing more options in non-discretionary goods such as utilities and groceries. An average active customer in FY23 was spending US$807 per year, which has now risen to US$1,419 in FY25, a 76% increase. Over the same time period, the average customer has increased transactions per year from 6.6 to 10.6. With ZIP offering payment options in more non-discretionary categories, we expect adoption from existing and new customers to accelerate into FY26.