Pilbara Minerals (PLS) - no subsidy required.

11 November 2025

Author: Sandstone Insights

Spodumene (lithium rock) prices declined by the order of 90% from extended levels at the beginning of 2023 through to a trough in the middle of 2025. New mines were coming into production but lithium demand from the uptake of Electric Vehicles (EV) had been slower than forecast. Many mines fell into a loss-making positions and some were eventually mothballed, an important step towards rebalancing the market.

Meanwhile the pace of EV uptake started accelerating, as did the installation of Battery Electric Storage Systems (ie. batteries to support the electricity grid - BESS), another important step toward rebalancing the market, and the spodumene market eventually found a bottom. From a low of ~US$635/tonne in June 2025, it rallied to over US$1,000/t by August before settling around US$820/t.

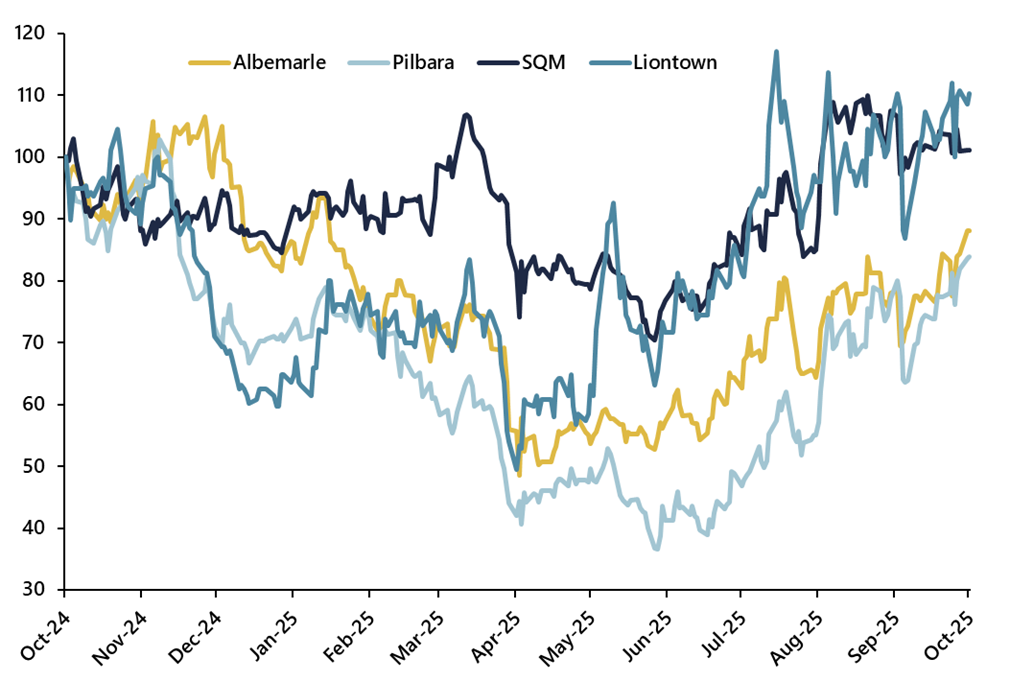

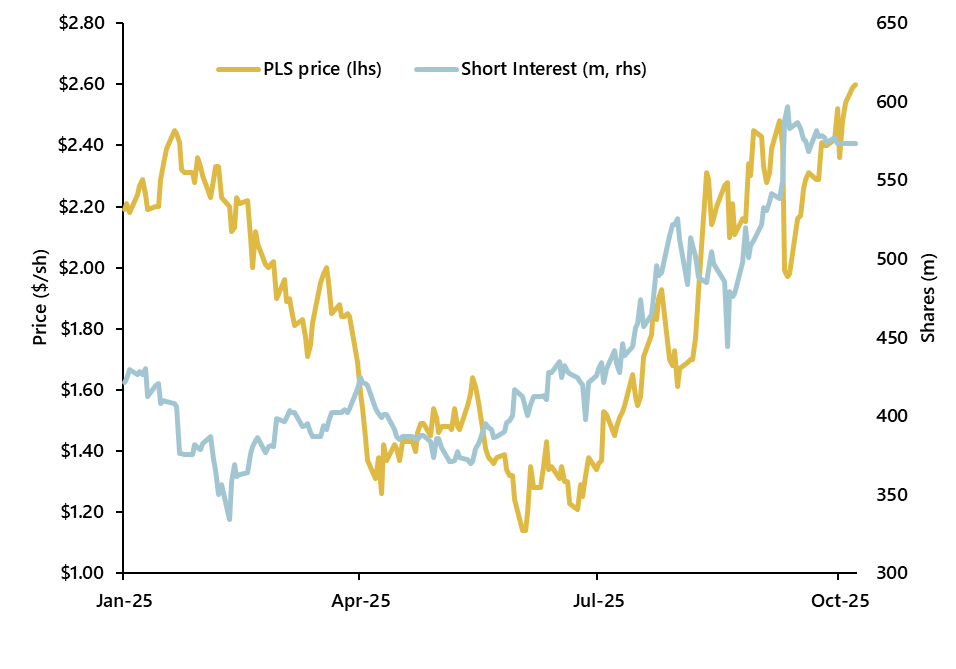

The stock prices of lithium miners such as Pilbara Minerals (PLS) anticipated the bottom in the lithium price and started moving higher. We have plotted below the relative share price performances Australia’s Liontown (LTR) & Pilbara Minerals (PLS) along with Chile’s Sociedad Química y Minera (SQM) and America’s Albemarle (ALB).