US software names crunched, now what?

12 September 2025

Author: Sandstone Insights

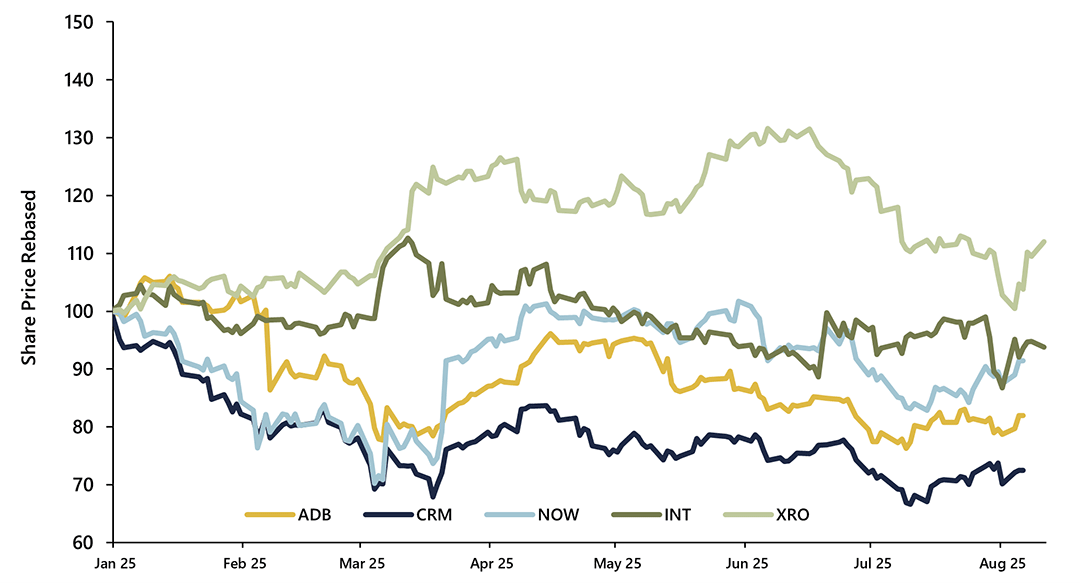

US software names like Adobe (ADBE.US), Salesforce (CRM.US), and ServiceNow (NOW.US) are among the worst performers in the S&P 500 this year, on fears that AI will disrupt the software business model. We outline the case for why AI will accelerate growth for software companies.

Crunched in 2025

High-profile fast-growing software businesses like Adobe, Salesforce, and ServiceNow have been some of the worst-performing stocks in the S&P 500 this year. Secular trends of software growth, powerful SaaS revenue models, and large total addressable markets with net cash balance sheets have allowed earnings to outpace revenue growth for many years.

Locally, the 25% sell-off in Xero (XRO) since its all-time high in Jun 25 presents a clear opportunity for investors to position themselves what we see as powerful secular trends.

Software vendors have provided the systems to companies from SMEs to global corporations for years, earning the trust of clients by delivering reliable, scalable solutions. The idea that AI will empower management teams to pivot away from their core business by using AI to develop in-house software makes little sense to us.