Why CSL is stuck. Consider ResMed

12 September 2025

Author: Sandstone Insights

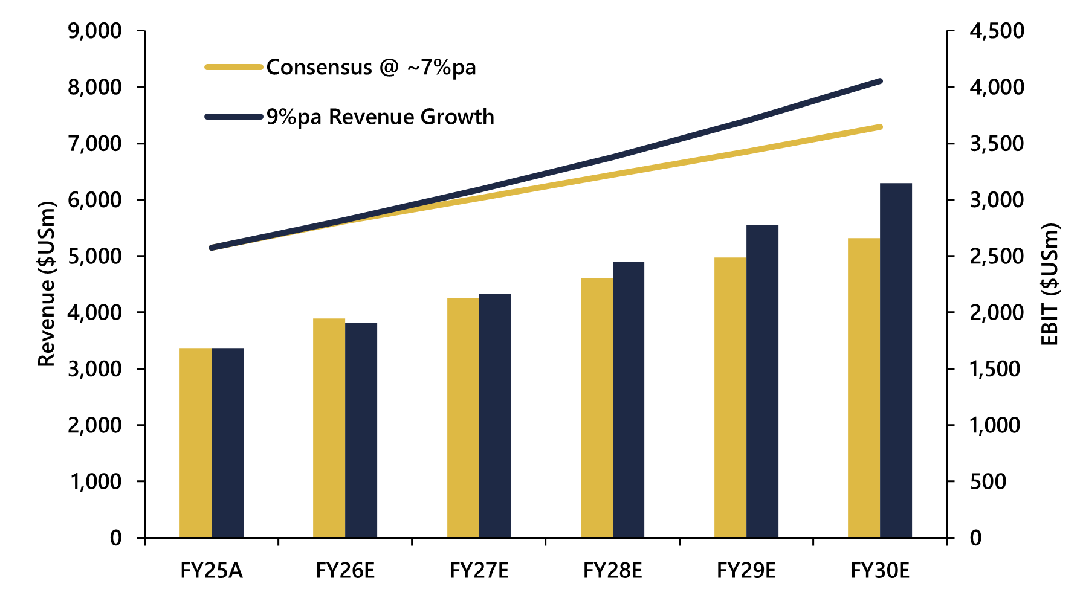

The CSL story has lost shine. Management has lost credibility with investors. The company has gone from growth to requiring significant cost out and restructures to maintain the prospects of double digit earnings growth.

Whilst there were some one-off factors impacting the FY25 result, we expect there are some more structural issues which will continue to plague CSL.

CSL’s bio-pharma business is not broken (just bruised). The small on market buyback is a useful signalling tool. But ultimately, we view the current share price as an ‘opportunity cost’ and likely to trade sideways until it can demonstrate some clear improvements in both its operating and earnings rhythm.

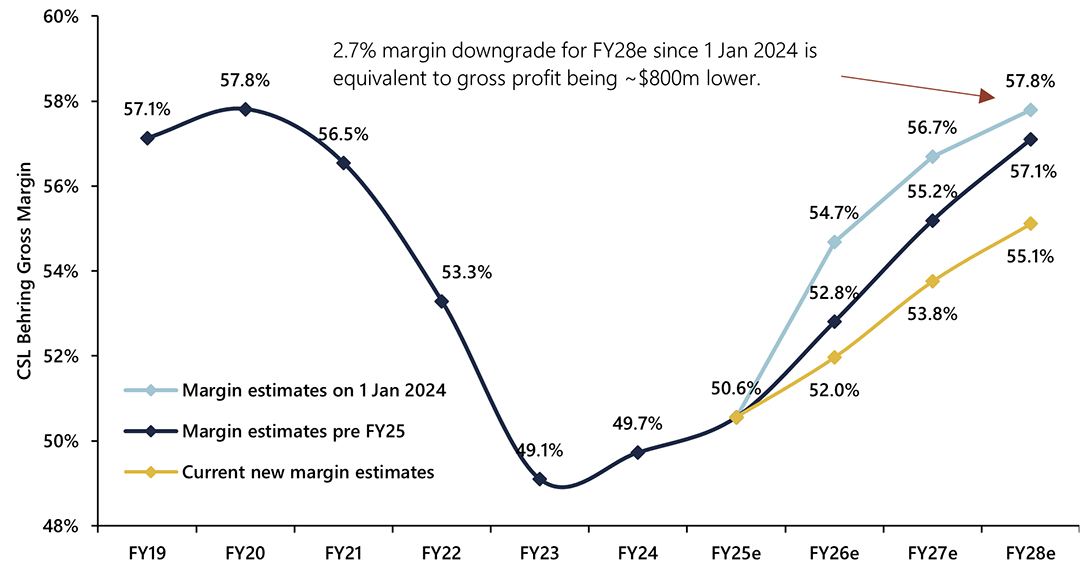

Estimates on 1 Jan 2024 for Behring gross profit were ~US$800m higher than where they are now at in mid Sep 2025. There is still significant execution required to return to a higher gross margin in the core blood plasma business.

With CSL only focussing on better priced tender contracts, we view risks to the actual volume growth of its plasma products. The pathway to pre-Covid margins is now much longer and may potentially not ever be reached.