The low down on property and shares

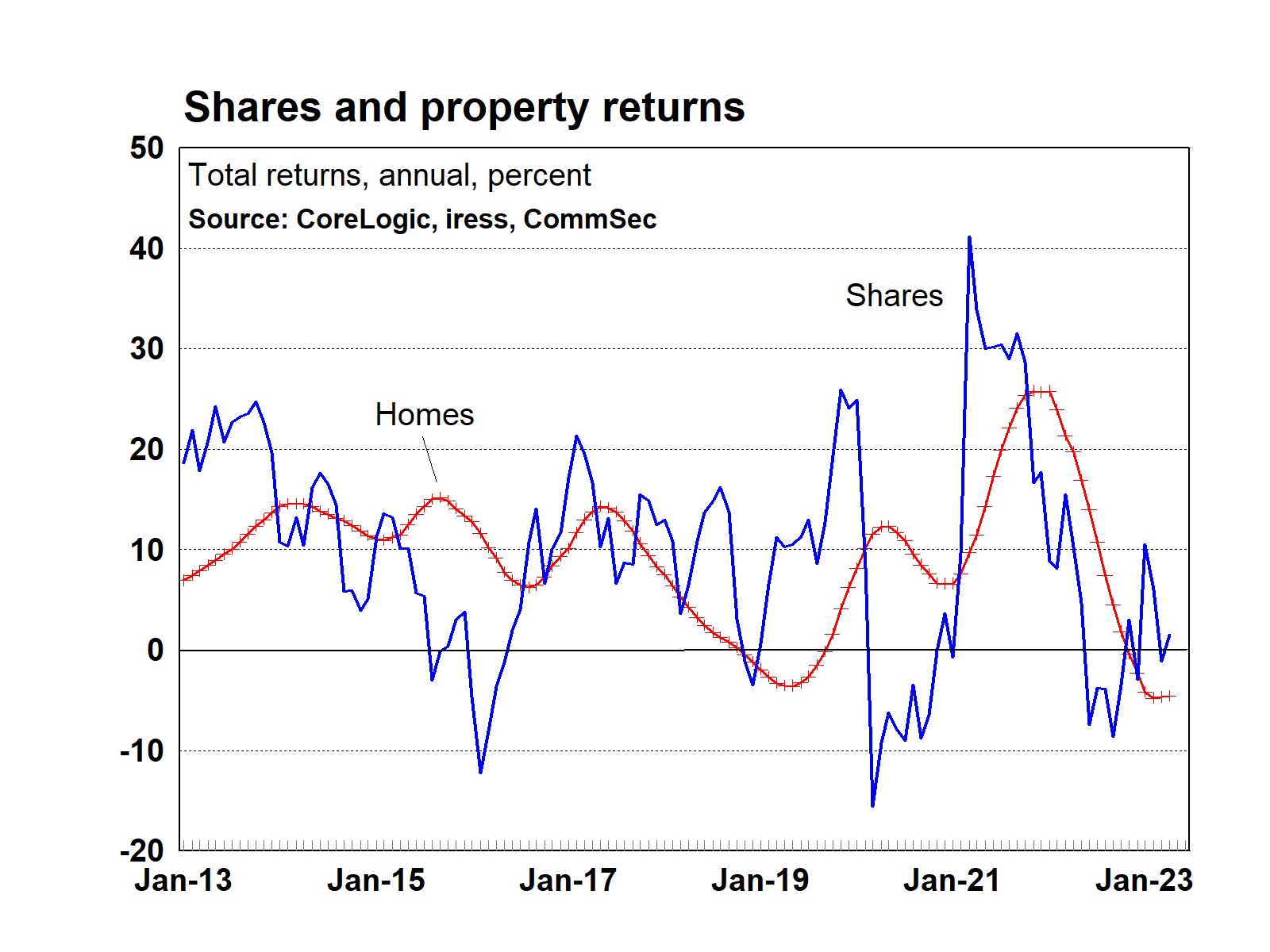

Both property and shares have produced good returns for investors over time. On average over the last decade, listed shares have produced total returns of around 9.5 per cent per year (Sources: CommSec, Iress). These returns are measured using the All Ordinaries Accumulation index.

Now, there are a number of observations.

The first is that the usual adage applies – past performance is no guarantee of future returns.

The second is that average returns will vary over time, depending on the time period used for comparison.

And the third is that we’re measuring broad returns for each asset class. The All Ordinaries Accumulation index was used to measure returns across the Australian sharemarket. And the CoreLogic total return series measures returns for houses and apartments across the country.

In practice, it may be harder to replicate the exact returns.

What is the All Ordinaries Accumulation Index?

The All Ordinaries Accumulation index or ‘All Ords’ tracks the 500 largest companies listed on the ASX. It’s considered the benchmark index for judging the performance of the broader Australian sharemarket.

For residential property over the same period, total returns averaged 9.4 per cent per year. In this case the returns have been measured using the total return series issued by property company CoreLogic.

While returns on shares were slightly ahead of those for residential property over the past decade, if the time period was reduced to eight years you’d see a slightly different result. In this case, average returns on residential property slightly exceeded those of listed shares.

Bricks and mortar, or real estate more broadly?

Certainly, in terms of the sharemarket, there are a number of ways that an investor can track the performance of the broader market or individual sectors. Options include Exchange-Traded funds (ETFs), listed investment companies (LICs) or a managed fund.

What is an ETF?

ETF is short for Exchange-Traded Fund. ETFs are asset bundles that allow you to invest in many stocks or bonds at once, giving you instant diversification. You can buy units in themed ETFs, like technology or sustainability, with CommSec Pocket.

Each approach is different – a topic we could cover extensively in another article in its own right! But, suffice it to say, there are a number of ways to track the Australian sharemarket rather than buying a raft of individually listed companies.

Now, for those seeking exposure to residential property the approach is usually a little different. That’s because people tend to favour property over shares because they like owning a ‘bricks and mortar’ or physical asset. But, the prospects for returns on that investment will depend on a range of factors such as the location, condition of the property and the type of property.

And, as is the case with purchasing shares in just one company, purchasing one physical residential property may not replicate the returns achieved for the broader Australian sharemarket. It may involve a number of property purchases, which could require a significant outlay in practice.

It is still possible, however, to track returns on property. It just requires a different approach. That is, you may need to purchase ETFs, LICs or managed funds to get the breadth of coverage.

One possible advantage here is that an investor could track returns on real estate more broadly. That is, obtain exposure to commercial property, such as retail spaces, offices and factories. And, apart from ETFs, LICs and managed funds, the door opens to real estate investment trusts (REITS).

It could also be that part of the allure of property is the desire to follow different aspects of the sector. This includes following the fortunes of building material suppliers, residential builders or developers, marketing or publishing groups and construction and engineering companies. While buying shares in individual companies may get you the exposure to property sector you seek, it could prove to be a more active approach requiring you to monitor the vagaries of property cycles.

So, what’s the answer: well, as is always the case with investments, there are a range of approaches available to suit your own goals and objectives.

Australia’s 10 largest stocks

What are the 10 largest stocks by market cap on the Australian sharemarket? Check it out here.

Choosing investments 101

With thousands of companies listed on the Australian sharemarket, it can be hard to decide what to invest in. Here’s the 101 on choosing your next investment.

Lessons from the dotcom

What happened during the dotcom era and is the same thing happening today? We take a closer look.

Important information

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited (formerly Chi-X Australia Pty Limited), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.

RP Data Pty Ltd t/a CoreLogic Asia Pacific (ABN 67 087 759 171) have provided the above views. These are external entities that are not members of the Commonwealth Bank of Australia Group of Companies (the Group) ABN 48 123 123 124, AFSL 234945 and the content does not represent an endorsement, recommendation, guarantee or advice in regard to any matter. Neither Commonwealth Securities Limited ABN 60 067 254 399, AFSL 238814 nor members of the Group accept any liability for losses or damage arising from any reliance on external companies and their products, services and material.

The data on this page has been provided by a number of external data vendors and has not been verified by us. All recommendations, data, calculation and values have been provided for your information only and should not be relied on for financial or any other purposes.

Commonwealth Securities Limited does not accept any responsibility for any losses suffered due to reliance on the data, calculations or values.

This information is not advice and is general in nature. The information has been prepared without taking account of the objectives , financial situation or needs of any particular individual. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to the individual's objectives , financial situation or needs, and, if necessary, seek appropriate professional advice. You can view the CommSec Terms and Conditions, Product Disclosure Statements, Best Execution Statement and Financial Services Guide, and should consider them before making any decision about these products and services.

Past performance is no guarantee of future performance.