CommSec

CommSec

15 Mar 2024

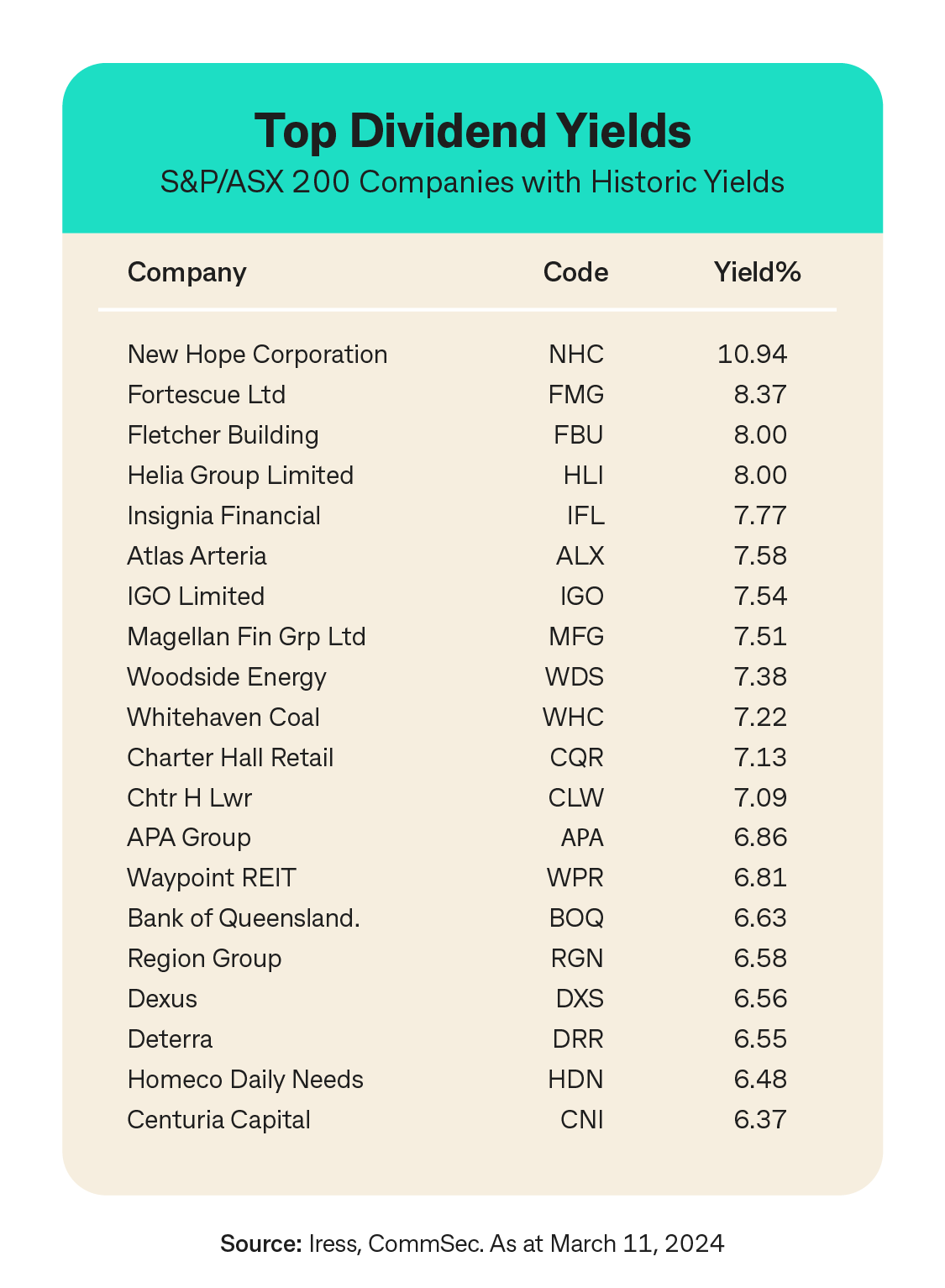

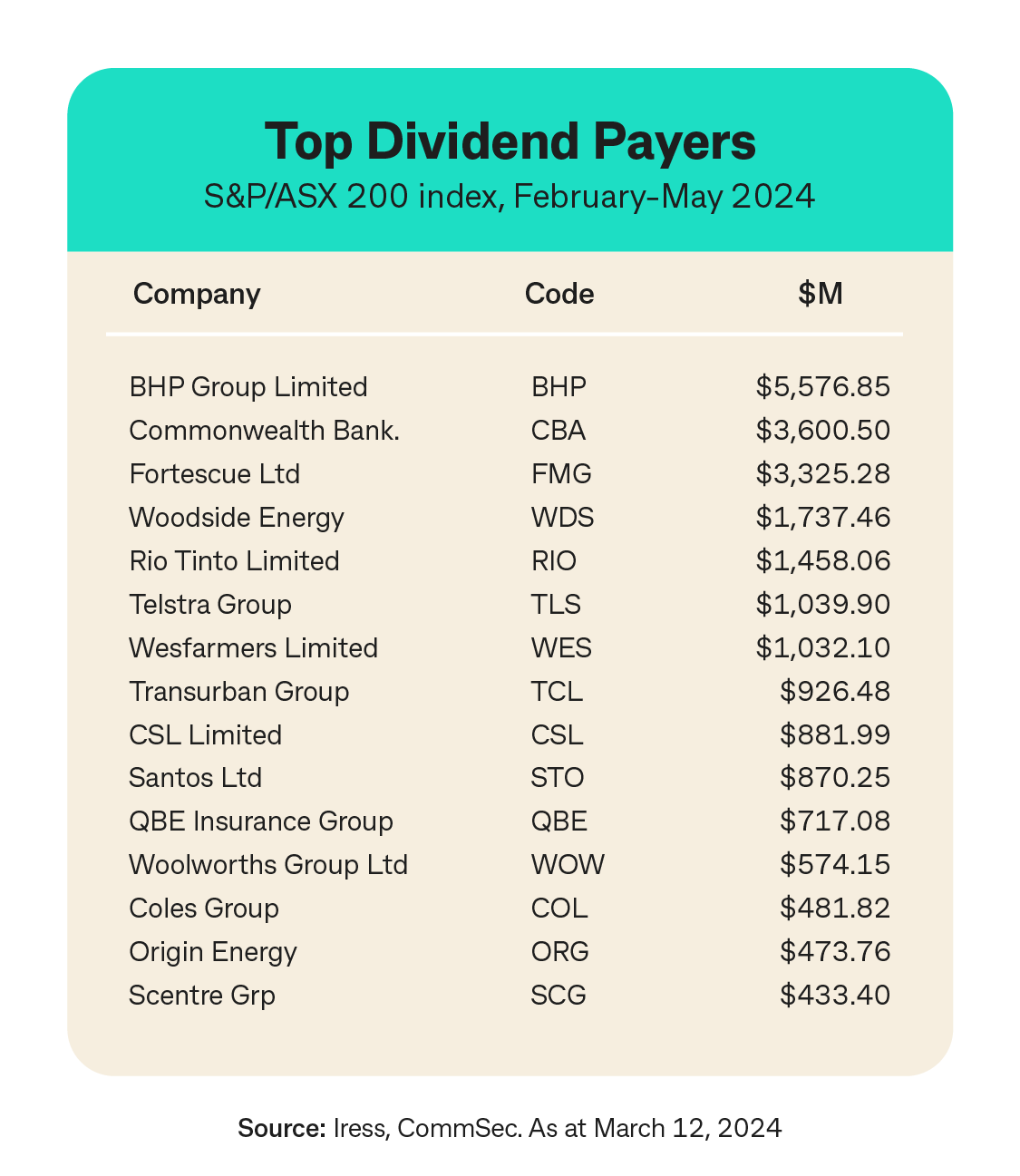

- Major Aussie companies classified in the S&P/ASX 200 index will pay out almost $34 billion in dividends in the space of nine weeks. While significant, the value of dividend payouts is less than the $35.1 billion paid in the equivalent period of 2023.

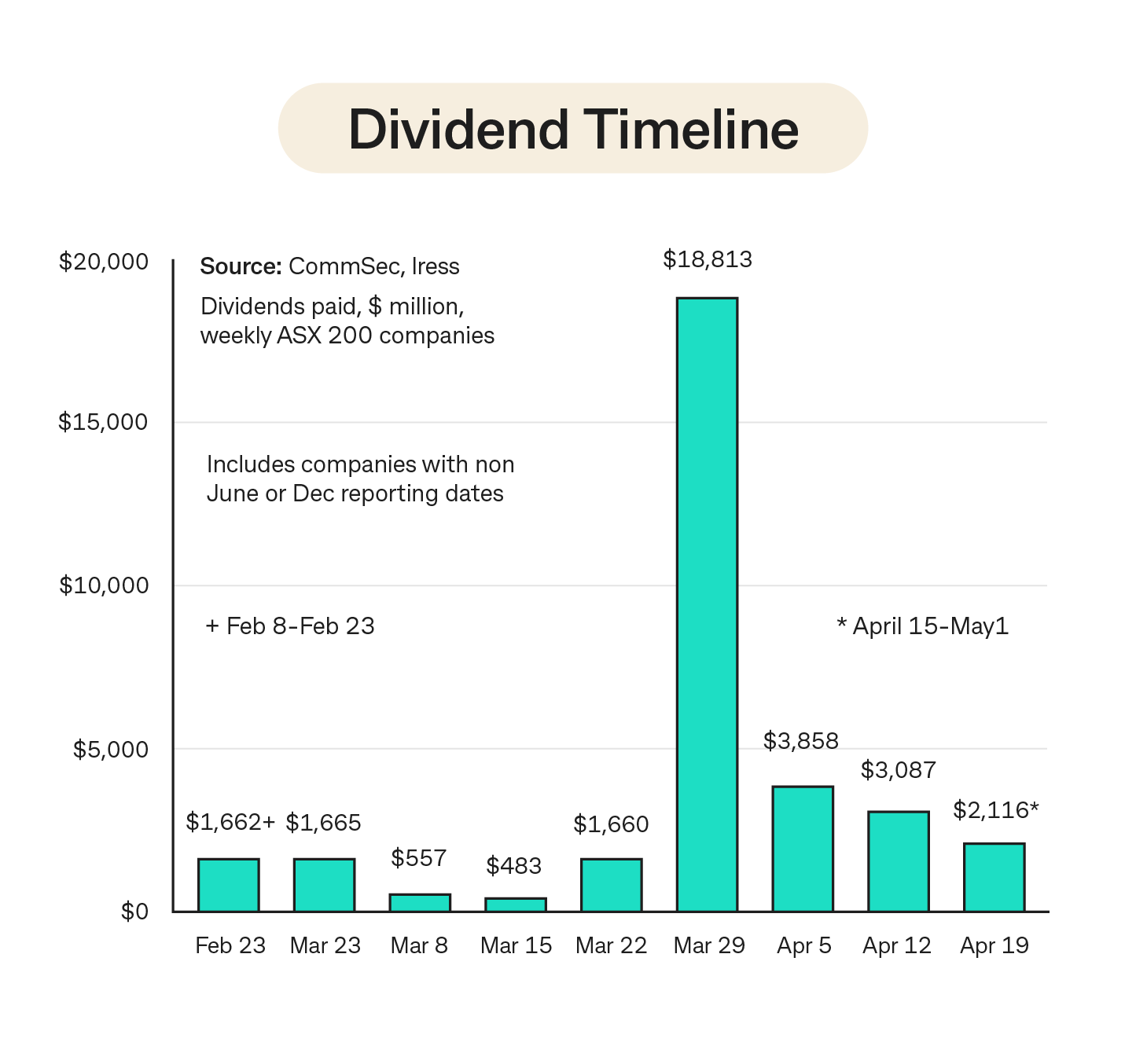

- The estimated 12-month forward dividend yield for the S&P/ASX 200 index is currently 3.9 per cent, below the long-run average near 4.7 per cent since 2005. But 45 companies in the ASX 200 currently have a dividend yield above 5 per cent.

- While profits have fallen over the past six months, companies have been keen on maintaining dividend payments especially in light of competitive returns on bank deposits, bonds and overseas shares.

The importance of dividends

Since the Global Financial Crisis the importance of dividends has grown due to the larger role they now play when it comes to total returns.

There are a few reasons for this.

The economy has continued to mature and the “potential” growth rate has eased from around 3.5 per cent to 2.3 per cent. And economic growth has slowed further over the past year to 1.5 per cent, reflecting the tightening of monetary policy.

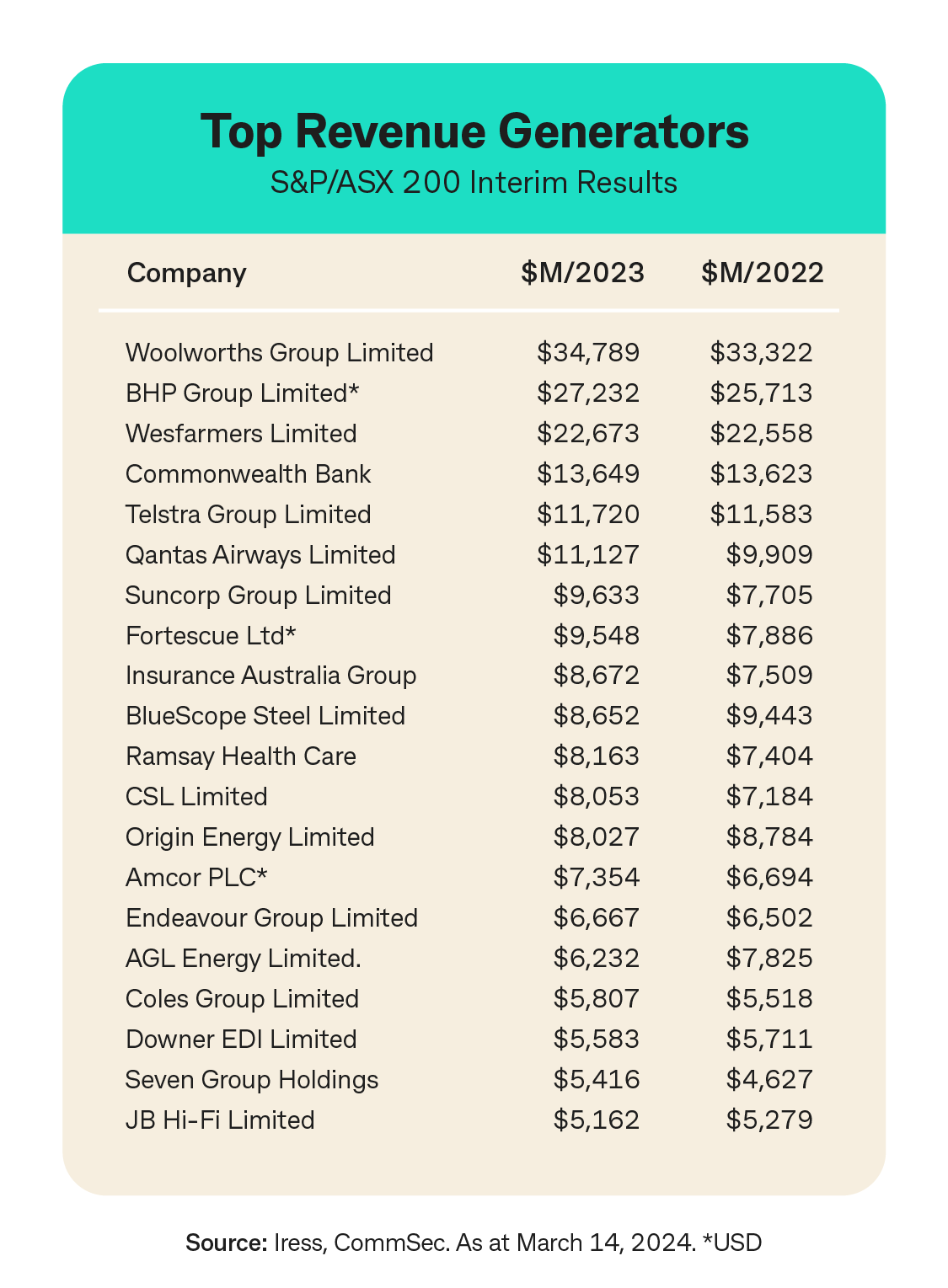

Many of Australia’s biggest companies operate in mature industries like banks, retailing, health and real estate investment trusts rather than “growth” industries such as technology. So while many companies continue to make money, growth options are more limited.

Over time, Australian companies have had to compete with property markets to grab the attention of investors. But over the last year, there has been further competition from rising bank deposit rates, the solid performance of overseas equities and even alternative assets like bitcoin.

But despite a more challenging operating environment, businesses have remained keen to maintain dividends.

To put it in context, our analysis of half-year earnings announcements found that only 81 per cent of S&P/ASX 200 companies recorded an interim profit, down from the long-term average of 87 per cent. And only 50 per cent lifted profits (long-term average 58 per cent).

Despite the lower profits, 83 per cent issued a dividend, only slightly below the long-term average of 85 per cent. And of the dividend payers, 52 per cent lifted dividends, 19 per cent held dividends steady and 29 per cent cut dividends.

Cash levels have been reduced from historically high levels to meet dividend payments. But the cash has also been used to meet higher wage costs (employing more staff at a higher cost), for purchasing new equipment, re-stocking inventories or as a buffer to deal with the on-going challenges of a tough business environment.

Outlook

Investors have the usual choice over the next few weeks. Those investors that still elect to receive dividend payments direct to their bank accounts can choose to spend the extra proceeds, save the proceeds (leave it in the bank) or use the funds in combination with other savings and reinvest into shares or other investments.

With the rising cost of living and interest rates at historically-high levels, some investors may use dividends to maintain their standard of living or meet higher loan repayments.

Of course there always are those investors that see longer-term opportunities – especially given recent volatility – choosing to channel the dividends into sharemarket purchases. The performance of investment returns over time when dividends are included in the calculation is especially emboldening – that old saying that ‘it is time in the market that is important rather than timing the market’.

From an investor perspective, dividend payouts are incredibly important. Regular income payments to investors can cushion portfolios from the bouts of volatility in sharemarkets, preserving capital. And the extra cash put ‘back to work’ in the sharemarket could help stabilise or even support the ASX in uncertain and ‘challenging’ times.

The big issue over the next six months is inflation. Success in getting inflation down into the 2-3 per cent target band would allow the Reserve Bank to cut rates, giving consumers extra dollars to spend and invest.

More confident and cashed-up consumers would be good news for business revenues and profits.

For export-focussed businesses, especially miners, the focus is on both the recovery of the Chinese economy and the success of the US Federal Reserve in controlling inflation.

We expect the Aussie sharemarket to drift through to mid-year as rate cut validation is gradually amassed – there will be successes and disappointments in the battle to reduce the pace of inflation. The S&P/ASX 200 index is expected to be trading in 7,750-8,050 point range near the close of 2024.

Back to

Back to