What exactly are Consumer Discretionary stocks?

The sector is dominated by retailers but also includes gaming stocks.

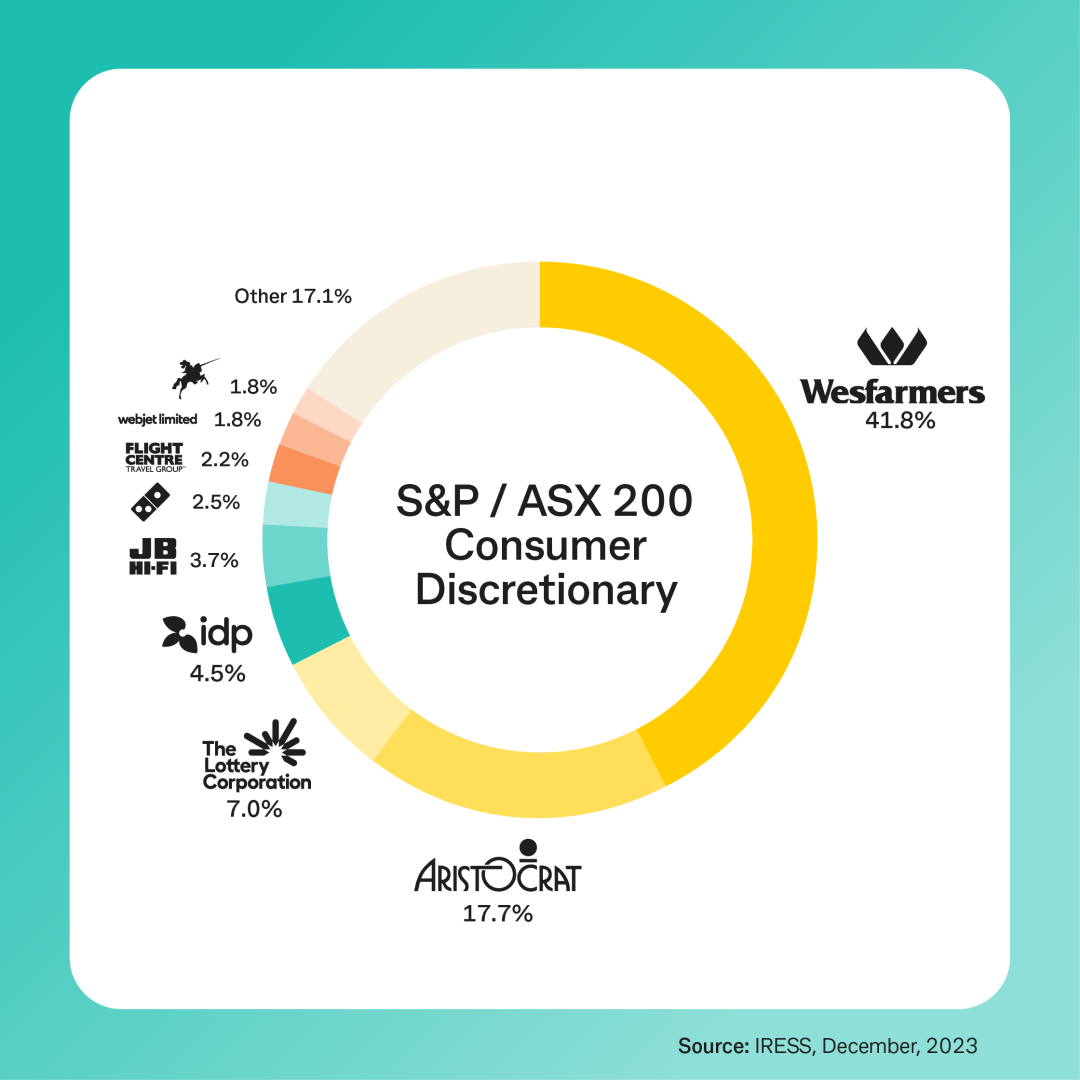

In Australia, there are around 120 companies that are defined in the broad Consumer Discretionary sector. The sector is dominated by the conglomerate, Wesfarmers, best known for the Bunnings hardware store. Next biggest is gaming company Aristocrat Leisure followed by The Lottery Corp.

But probably best known are retailers such as Harvey Norman, JB Hi-Fi and pizza chain, Domino’s.

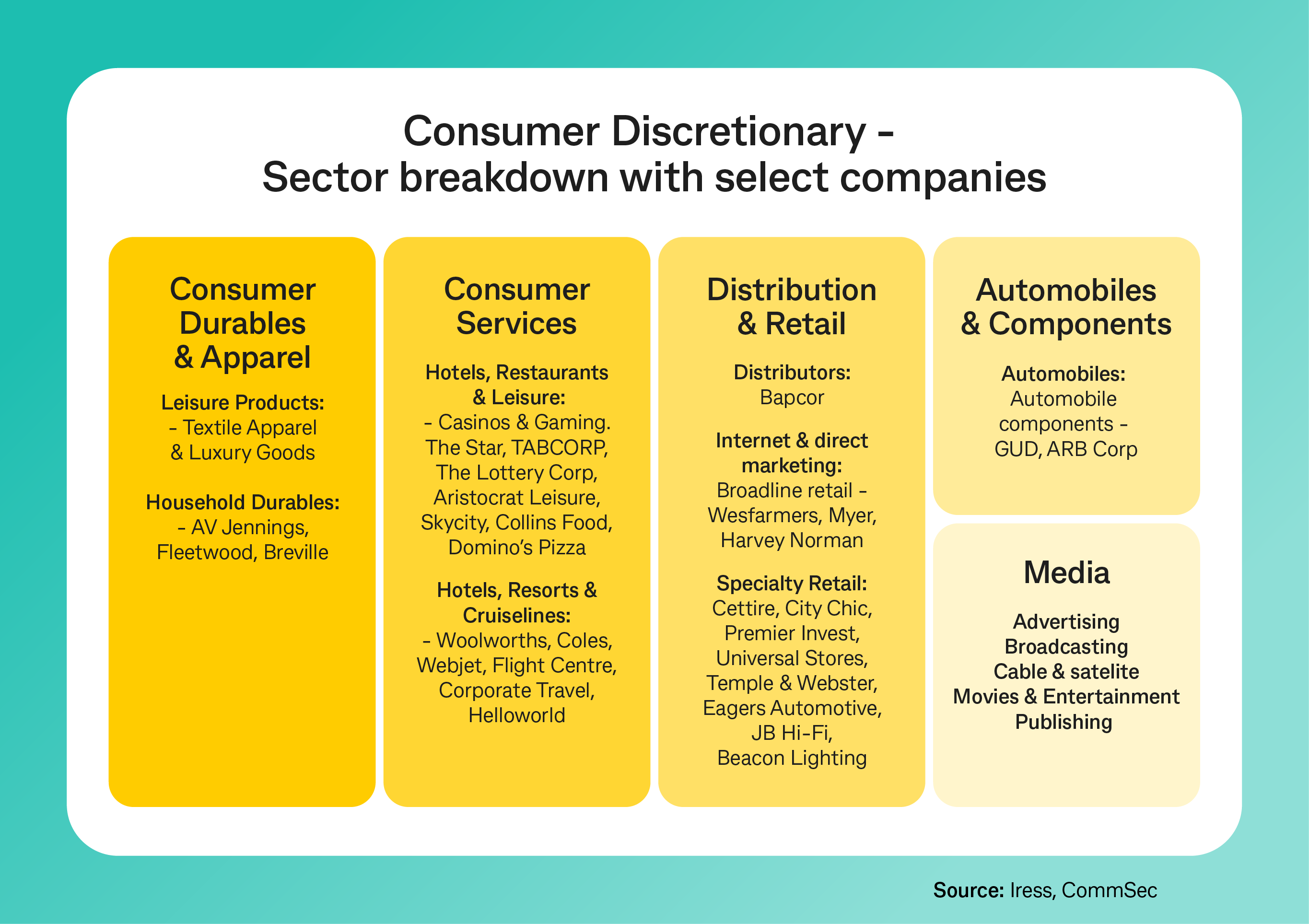

The table below shows how the Consumer Discretionary sector is broken up.

Why would you invest in Consumer Discretionary?

Many of the stocks in the Consumer Discretionary sector operate household names, such as Bunnings, Flight Centre and KFC (the latter under the Collins Food umbrella).

Investors that are keen shoppers will understand the operating environment of many companies in the sectors such as the major retailers. And investors can get a sense in a real way about how the companies are faring.

A number of the stocks in the sector also provide regular updates on sales trends, and many of the retailers do this on a quarterly basis.

Favourable times for investors in Consumer Discretionary stocks are periods when unemployment is low, wages are rising at a sustainable rate and interest rates are flat or falling.

Alternatively, when interest rates are rising and consumers are gloomier, the operating environment is more challenging for consumer-dependent companies. These times will reveal just how good management are in responding to tougher times.

What are the risks of investing in Consumer Discretionary stocks?

Unemployment is a key driver of consumer spending – when interest rates are low as well as when inflationary pressures exist and interest rates are rising.

And while consumer sentiment can be weak in times of rising rates, provided people have jobs and wages are growing at a faster pace than inflation, then consumers will continue to spend.

Pricing is a key risk for Consumer Discretionary stocks. Maintain prices too high and consumers will march to the opposition. And if prices are too low, the resulting tight margins may pressure profitability.

As always, investors need to be forward looking. Waiting until operating conditions are buoyant and you may lose the advantage of investing when share prices are low.

As is always the case, investors can get exposure to the Consumer Discretionary sector directly by buying shares in companies represented in the sector. But there are also a number of exchange trade funds (ETFs) that are offered.

Of course, investing in any single sector or company always carries risk, which should be assessed and weighed against your general risk tolerance and investment strategy.

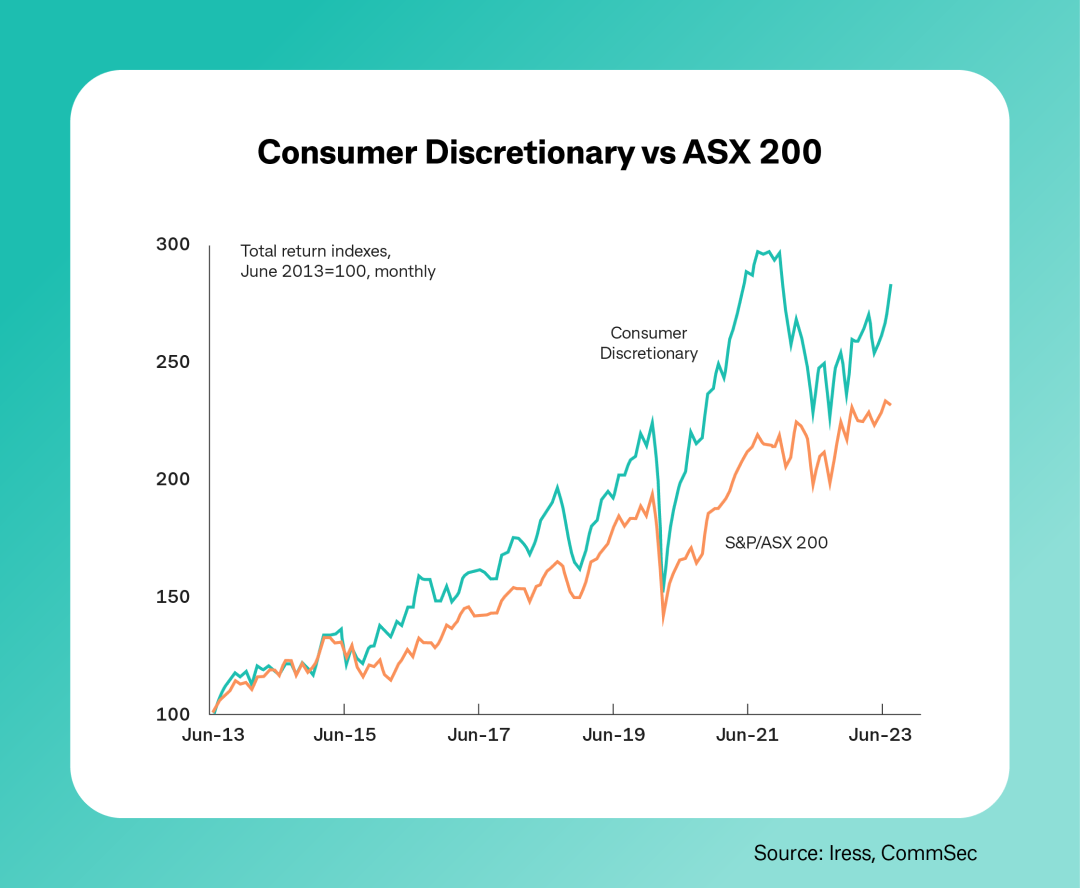

How has the sector performed over time?

Over the past decade, the Consumer Discretionary sector of the sharemarket has out-performed the broader ASX200 index. Total returns on the Consumer Staples sector have lifted 12.4 per cent on average per annum, above the 9.0 per cent per annum lift for the ASX 200 index.

The Consumer Discretionary share price index has lifted 7.5 per cent a year, while dividends have increased on average by around 5 per cent a year. In comparison, the ASX 200 share index has increased at a slower 4.2 per cent a year while dividend growth has averaged 4.8 per cent a year. Overall, total returns in the Consumer Discretionary sector were the third highest of the 11 industry sectors on average over the past decade.

Final thoughts before you invest

Investors may be attracted to household names but it is important that this doesn’t affect your judgement. The head still has to rule the heart on decisions to buy or sell shares, rather than sentiment attaching to a particular retailer.

The Consumer Discretionary sector is regarded as a ‘growth dependent’ area of the sharemarket, relying on favourable economic times to drive profits and share prices. But as noted, there are still a healthy number of stocks providing consistent and attractive dividends.

As always it’s important to take into account the management and strategy of the company, the specific industry that it operates in, presence of pricing power, financial track record as well as the current and prospective economic environment.

Author: Craig James, Chief Equities Economist