Breaking down the financials sector

As mentioned, you can’t have a strong economy, or for that matter, a strong sharemarket, unless you have strong financial institutions, including banks, insurers, investment banks and services providers.

CBA is the biggest company in the financial sector, followed by the remainder of the big 4 – NAB, Westpac, ANZ. Or perhaps it is the big 5 – as Macquarie is close behind the ANZ Bank in market size.

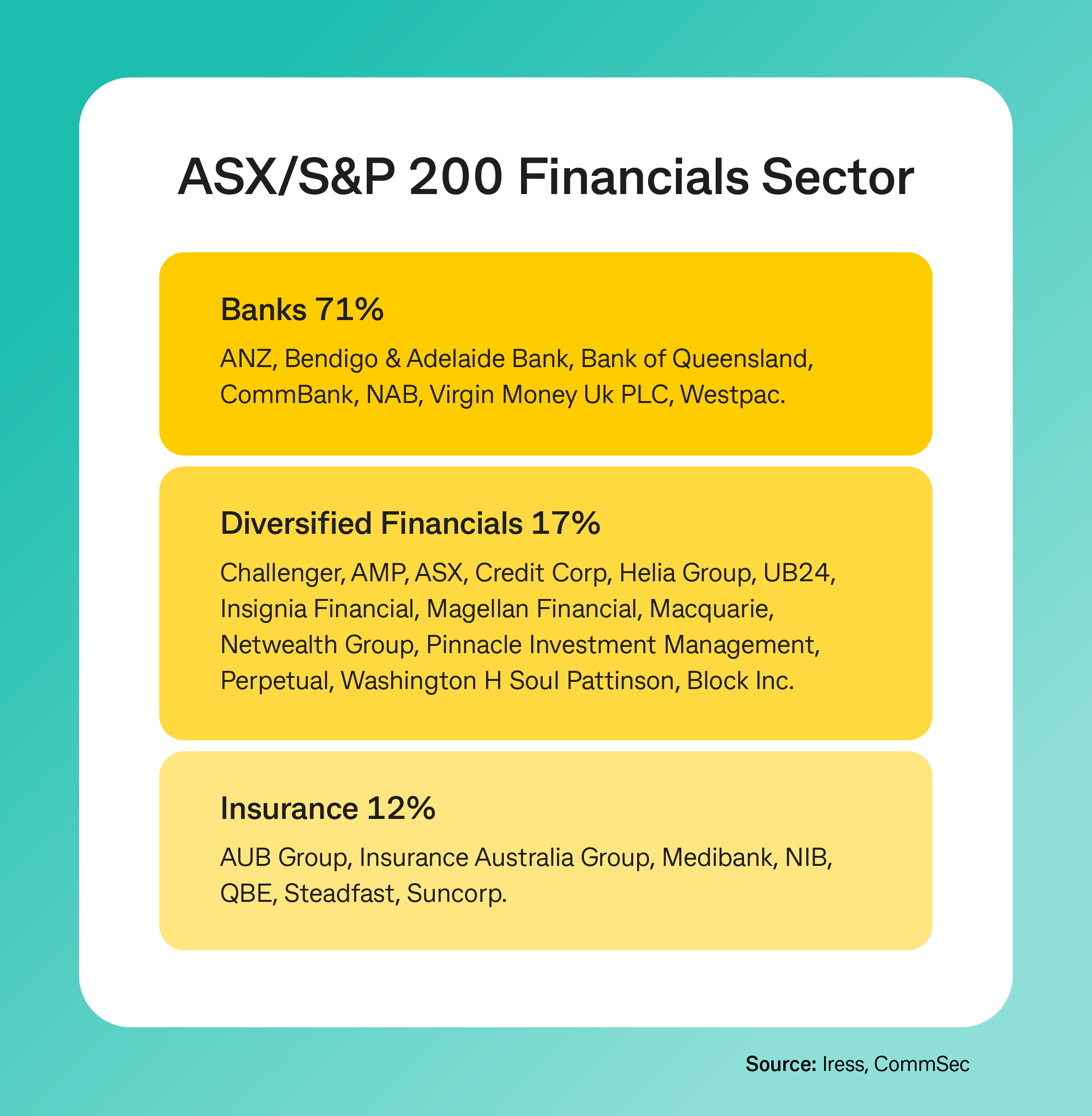

By numbers, roughly 30 of the ASX 200 companies can be found in the Financials sector.

The previous table shows how the Financials sector is broken up.

Why would you invest in the Financials sector?

Simply, if you are trying to replicate the ASX 200 index in your portfolio, you would need to include a number of financial sector companies.

However, because the Financials sector is very mature, investors in the pursuit of dividends are more attracted to the sector rather than those in pursuit of capital growth (growth of the share price).

Banks also tend to offer attraction when interest rates are rising due to the tendency of interest rates on loans to rise at a faster pace than deposit rates (margin expansion). When interest rates are relatively low and falling, deposit rates have less scope to fall (the zero boundary – that is, interest rates can’t really fall below zero for a sustained period), creating risk of margin contraction.

What are the risks of investing in Financials stocks?

Due to the defensive qualities of the sectors, over-investment in stocks in the Banks and Insurance sectors can potentially reduce scope for capital growth of your portfolio. That is, there is potential for smaller returns – but potentially less volatility – than other sectors.

As always, investors need to be forward looking. Waiting until operating conditions are buoyant, and you may lose the advantage of investing when share prices are low.

A forward-looking focus is especially important when it comes to interest rates. High interest rates could lead to a greater risk of loan defaults being recorded by bank customers. Falling interest rates – especially when rates are near zero – can lead to compression of interest rate margins – the gap between loan and deposit rates. Alternatively, modestly rising interest rates can lead to expansion of margins. At times when economies and sharemarkets are weak, investors can face the risk of weaker returns on investments in Financial Services companies.

For Insurance companies, risks relate to weak economies and over-exposure in the assets they hold, like government bonds, when rates are rising.

Natural disasters can also pose risks to the profitability of Insurance companies.

As is always the case, investors can get exposure to the Financials sector directly by buying shares in companies represented in the sector. But there are also a number of exchange traded funds (ETFs) that are offered that cover the Financials sector.

Of course, investing in any single sector or company always carries risk, which should be assessed and weighed against your general risk tolerance and investment strategy.

How has the sector performed over time?

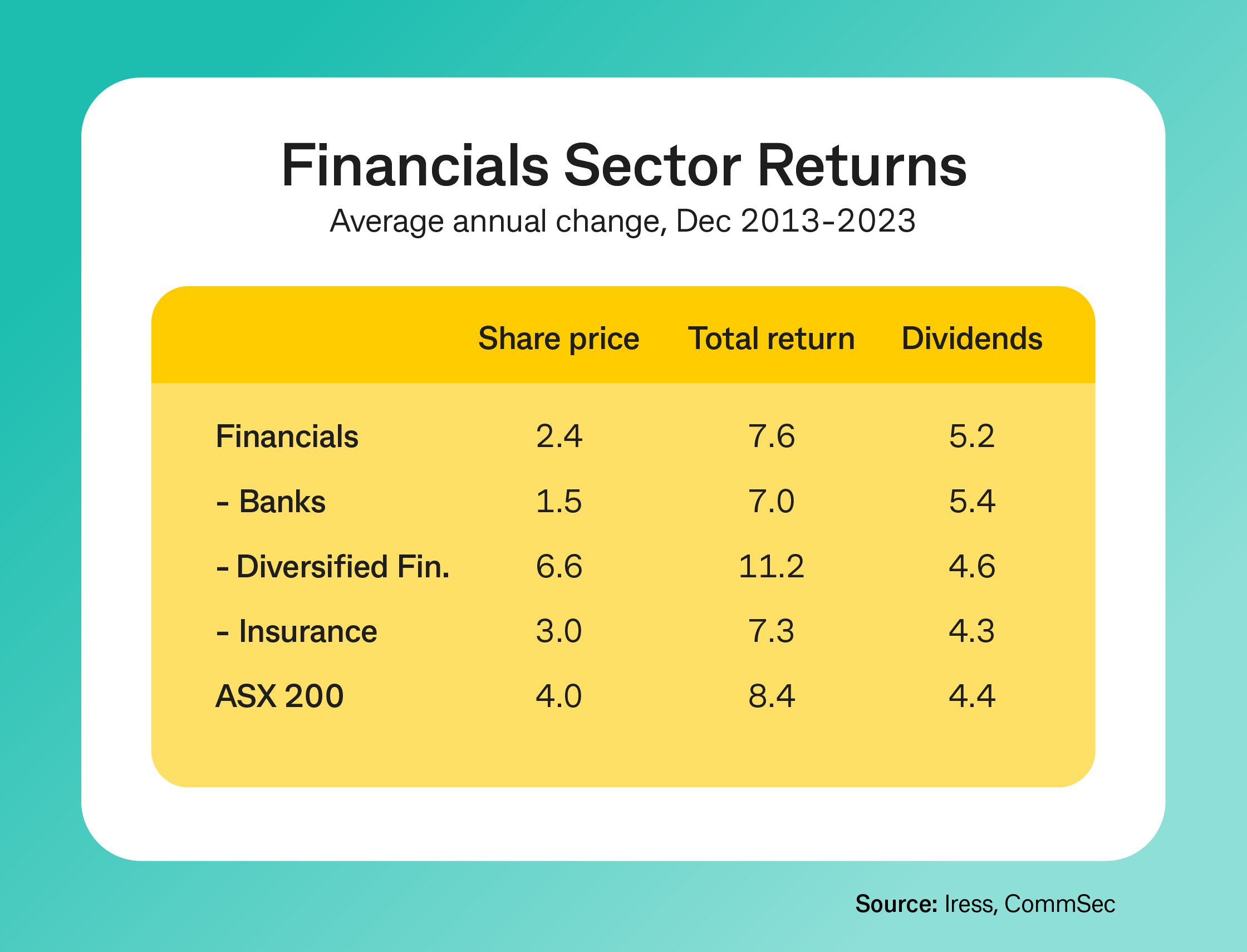

Over the past decade, the Financials sector of the sharemarket has under-performed the broader ASX200 index. Total annual returns on the Financials sector averaged 7.6 per cent on average per annum, below the 8.4 per cent average per annum lift for the ASX 200 index.

The Financials share price index has lifted on average by 2.4 per cent a year, while dividends have increased on average by around 5.2 per cent a year. In comparison, the ASX 200 share index has increased at a faster 4 per cent a year while dividend growth has averaged 4.4 per cent a year.

Overall, total returns in the Financials sector were the eighth highest of the 11 industry sectors on average over the past decade.

But it is important to note the differences in performance for the sub-sectors. This is shown in the table below.

On paper, Diversified Financials has outperformed in the past decade, but this may reflect returns made on Macquarie Group shares which more than doubled (2.3 times) over the decade.

As always, past performance is no guarantee of future performance.

Final thoughts before you invest

While you may be attracted to household names, it is important that this doesn’t affect your judgement. The head still has to rule the heart on decisions to buy or sell shares, rather than sentiment attached to a particular company or brand.

The Financials sector is regarded as a ‘safe haven’ area of the sharemarket, with investors relying on dividends to drive total returns rather than capital growth of shares.

As always, it’s important to take into account the management and strategy of the company, the specific industry that it operates in, presence of pricing power, financial track record as well as the current and prospective economic environment.